If you wish to maintain your distributors joyful, you want to be certain they’re paid on time. That’s the place QuickBooks is available in. QuickBooks On-line and QuickBooks Desktop supply a number of methods to make your vendor cost course of simpler.

On this weblog submit, you’ll discover ways to pay distributors in each on-line and desktop variations of QuickBooks.

Whether or not you favor on-line invoice pay or conventional checks, we’ll stroll you thru the method. We’ll cowl making use of credit, scheduling funds, and ensuring your distributors get their cash on time.

What’s QuickBooks?

QuickBooks provides small companies, startups, and solopreneurs complete bookkeeping, accounting, cost processing, and normal monetary administration advantages with many extra options as well.

Whereas not essentially strong sufficient for enterprise-level operations, QuickBooks’ standout qualities embrace an intuitive interface that’s easy sufficient for even accounting novices to navigate and a spread of third-party add-ons and integrations that cowl gaps missing on the native platform.

QuickBooks On-line vs. QuickBooks Desktop

QuickBooks On-line is a browser-only platform saved within the cloud, you possibly can entry your books, pay distributors, and extra from a cellular system or any laptop together with your login credentials. Likewise, cloud-connected accessibility means a number of regionally separated customers can use vendor cost features remotely when given acceptable authorizations.

Although now a legacy product whereas the platform goes by way of a deliberate sundown, present customers can proceed leveraging their one-time licensing buy to make use of the platform put in on their laptop. As an area software program, QuickBooks Desktop lacks the cloud-connected capabilities of QuickBooks On-line (except put in through a internet hosting service). Vendor funds usually operate the identical in each QuickBooks On-line and Desktop, although some person interface features could differ barely.

How Does QuickBooks Funds Work?

QuickBooks Funds lets distributors and enterprise homeowners alike streamline cost processing immediately in-app. Whereas restricted in some respects, customers can ship invoices or cost requests on to clients and purchasers and receives a commission through PayPal, credit score/debit card, ACH, Apple Pay, and even Venmo.

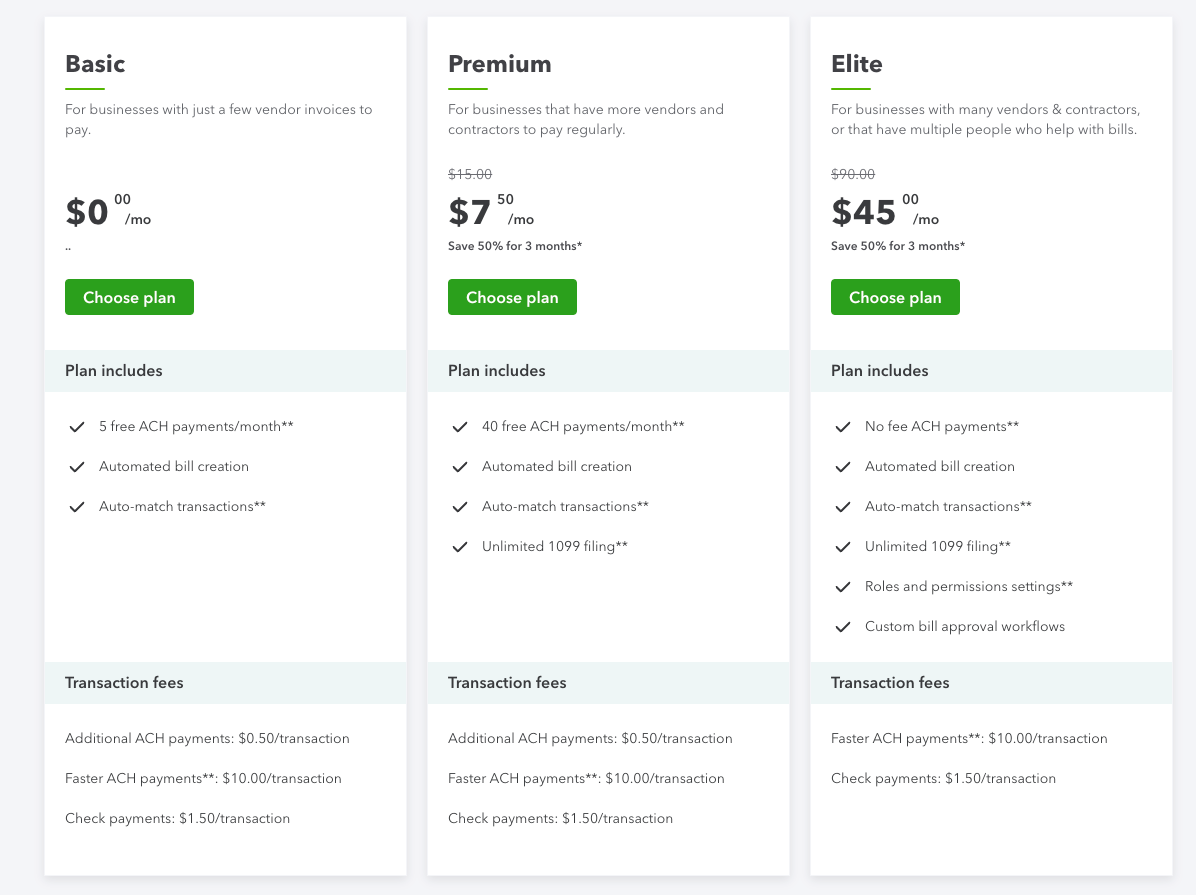

The bottom tier, Primary, is free however provides simply 5 free month-to-month ACH funds. Past that, you’ll pay $0.50 per ACH cost and may elect to pay $10 per transaction to expedite ACH funds. Test cost processing is $1.50 per test.

The Premium tier is $7.50 monthly and consists of 40 free ACH funds, with extra funds on the identical payment schedule because the Primary plan.

The highest plan, Elite, at $45 monthly, consists of no-fee ACH funds and extra workflows for customers with extra strong cost processing wants.

Extra Charges

Past the essential month-to-month subscription, you’ll additionally pay a spread of charges relying on the transaction sort and cost methodology:

- Bank cards and digital wallets: 2.99% of the full transaction

- ACH financial institution funds: 1%

- Card reader: 2.5%

- Manually entered playing cards (keyed-in): 3.5%

Utilizing QuickBooks Funds to Distributors

Since it’s immediately built-in into the platform, utilizing QuickBooks Funds is straightforward.

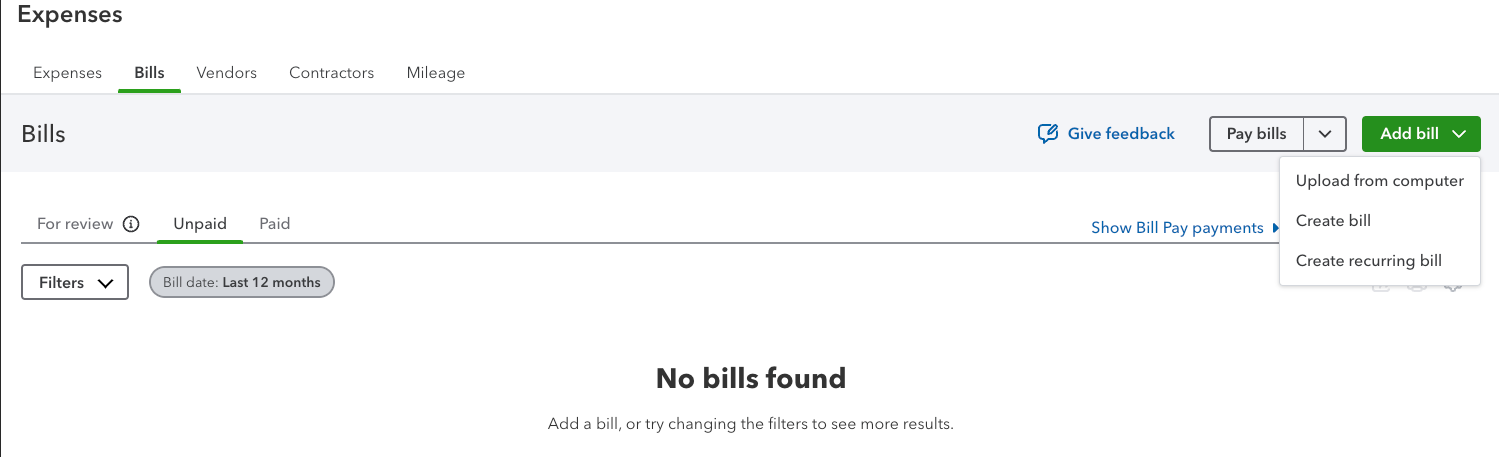

- You’ll need to first navigate to Bills within the sidebar, then click on Payments to open the seller cost administration dashboard.

- From there, assuming you aren’t paying immediately from an bill or present doc, click on Add Invoice within the prime rightmost nook.

- Then click on Create Invoice (you can even create a recurring invoice from this workflow).

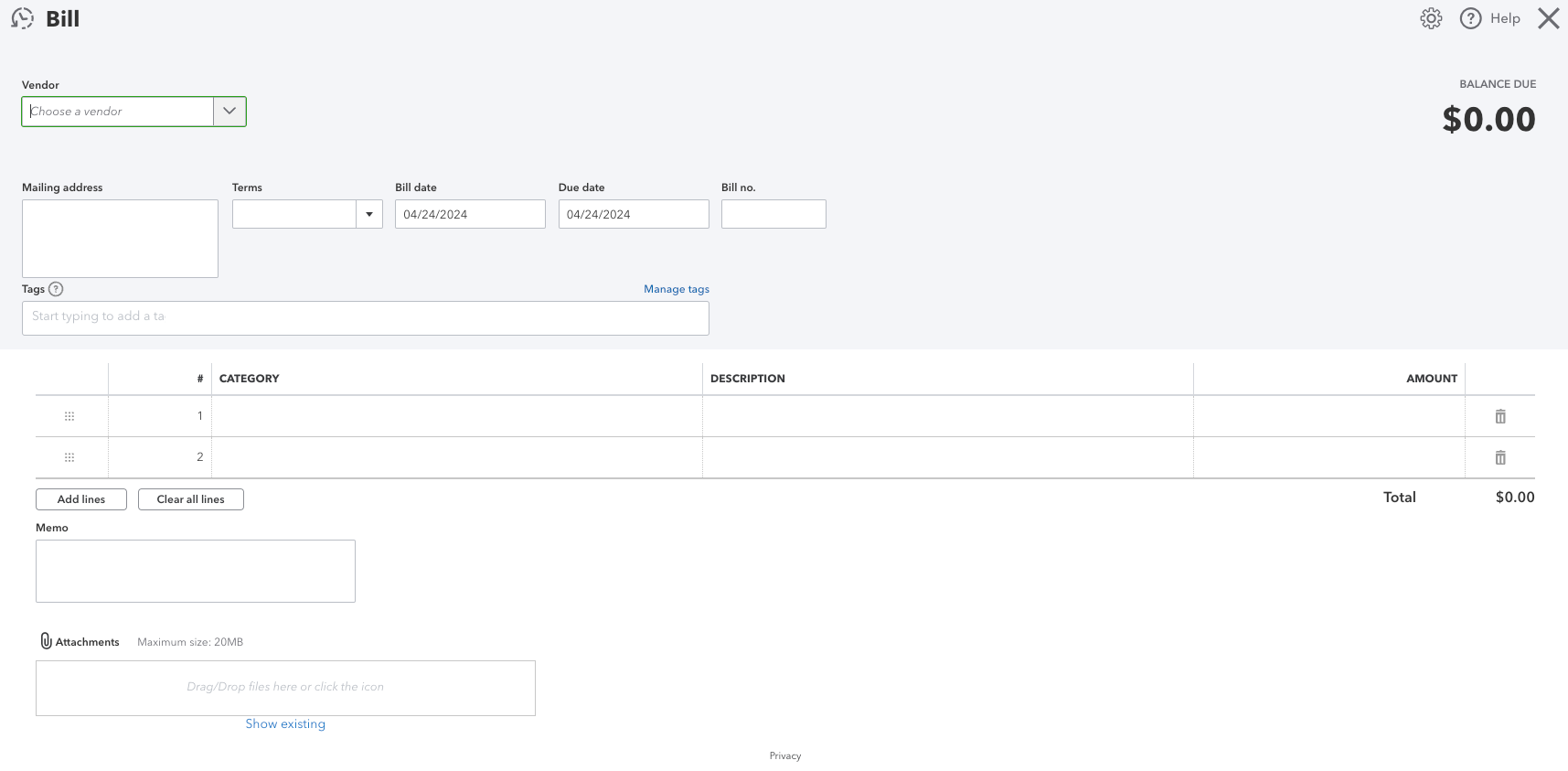

- You’ll then see a clean invoice window and plug in all related vendor data throughout the entry fields.

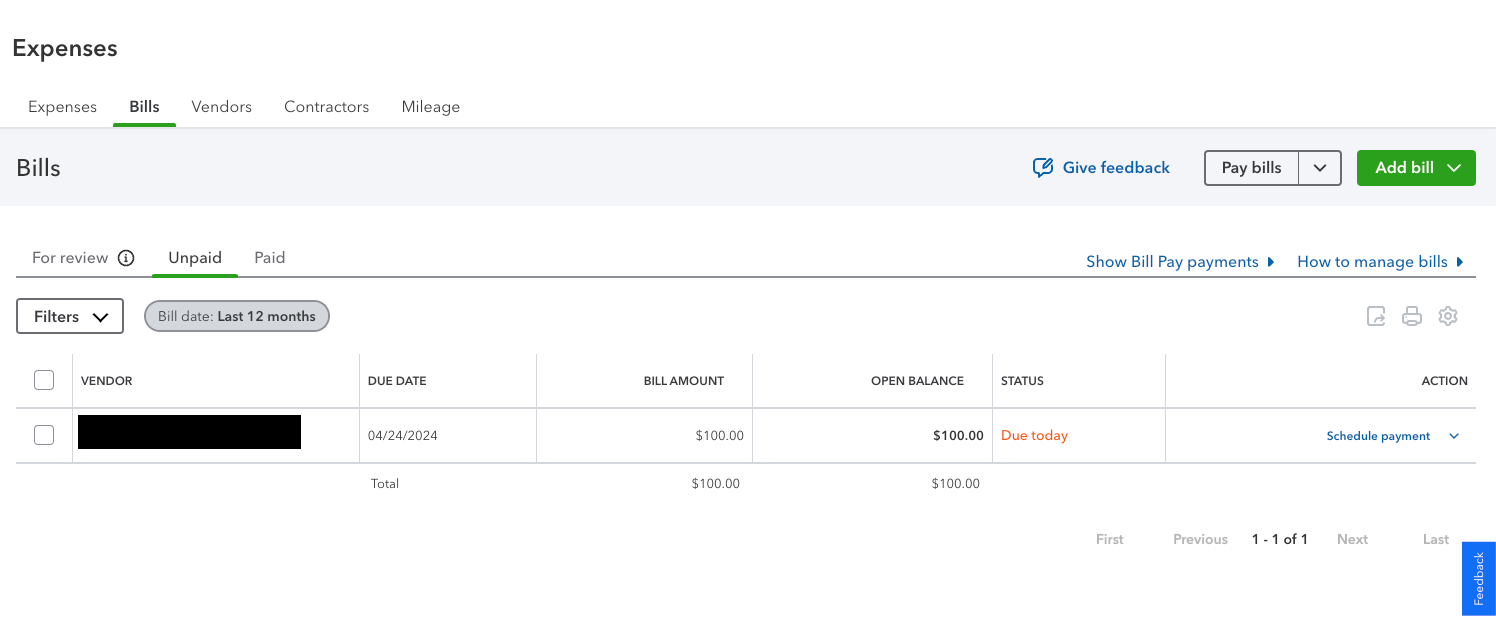

- As soon as saved, you’ll return to the seller dashboard and may schedule cost.

- You will enter your cost data from the Schedule Cost window and schedule the cost.

That is additionally methods to pay distributors through ACH when utilizing QuickBooks On-line, although you possibly can enter any licensed and obtainable cost methodology inside this window.

Advantages of QuickBooks Vendor Funds

There’s one thing to be mentioned for simplicity, and preserving vendor funds nested inside your wider accounting and bookkeeping ecosystem goes a good distance towards simplifying your monetary life. A few of the key added options embrace:

- Automated matching – Confirm that the main points on the acquisition orders and the related invoices match in order that the bill may be paid

- Information centralization – A single supply of fact for improved decision-making

- Cost Scheduling – Define the timing, frequency, and quantity of funds

- Visualization – Current key metrics in visible type for optimum insights

All the above serve to streamline workflows and maintain an correct tally of the money leaving your corporation – whereas leveraging QuickBooks’ strong safety protocols.

Conclusion

QuickBooks Invoice Pay and Funds are a easy, closed-loop collection of vendor cost workflows to streamline and simplify your provider or contractor cost processes. Although the ins and outs could take some getting used to, the benefit of use and talent to maintain tabs in your whole monetary system is underrated as we more and more complexify our enterprise lives.

Continuously Requested Questions

Can I pay distributors immediately by way of QuickBooks?

Sure! You possibly can pay distributors through ACH, debit, or bank card by way of QuickBooks simply. You may as well choose extra cost choices through third-party plugins or guide cost administration instruments throughout the platform.

Can I create vendor credit in QuickBooks?

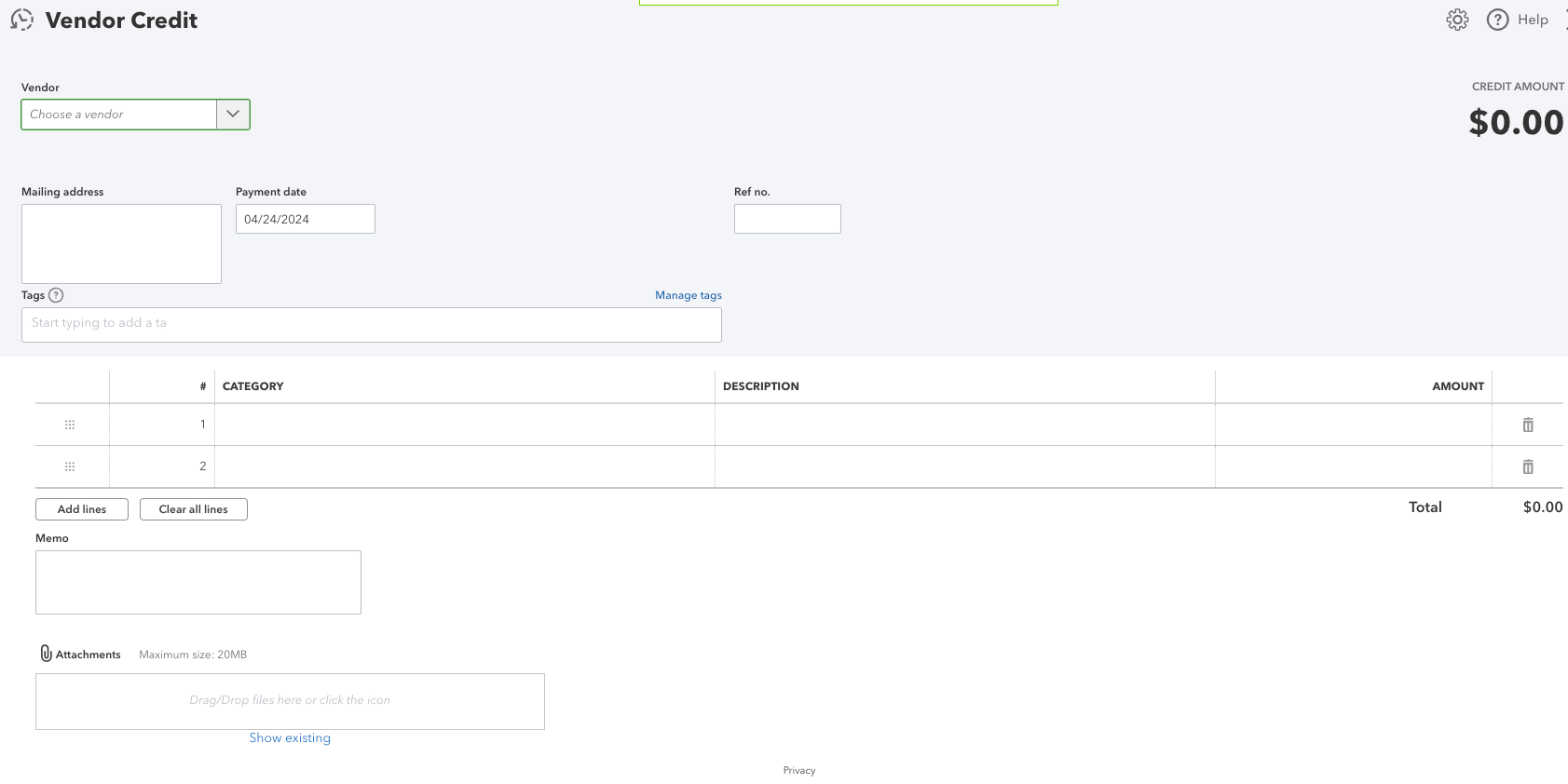

Sure! To create a vendor credit score in QuickBooks On-line to drop your owed quantity:

- Merely click on Create

- Then choose Vendor Credit score. You’ll see the seller portal the place you possibly can enter all related knowledge.

- Return to the Invoice Cost dashboard to use the credit score to an present invoice.

- Then, go to Credit and mark the related vendor credit score earlier than saving and shutting the invoice.

Creating vendor credit in QuickBooks Desktop is way the identical, although

- you’ll first navigate to Distributors

- and then Pay Payments to set the related vendor credit score inside an present invoice.

Can I edit or cancel a web-based cost after sending it?

Sure, although time is of the essence. Relying upon how lengthy it’s been since despatched:

- You possibly can Delete the Cost, which removes it out of your information, or

- Void a Cost, which units the cost quantity to zero.

Notice that neither returns cash to your account—in these cases, you’ll must request a direct deposit reversal or work with the seller to refund half or the entire cost.

How Can I Streamline Vendor Funds with QuickBooks?

A variety of third-party plugins and integrations can enhance vendor cost administration in QuickBooks, akin to Nanonets’ accounts payable automation instruments, which makes use of synthetic intelligence to match invoices to buy orders, streamline approvals, and lower down on time spent (and inevitable errors) related to guide entries.