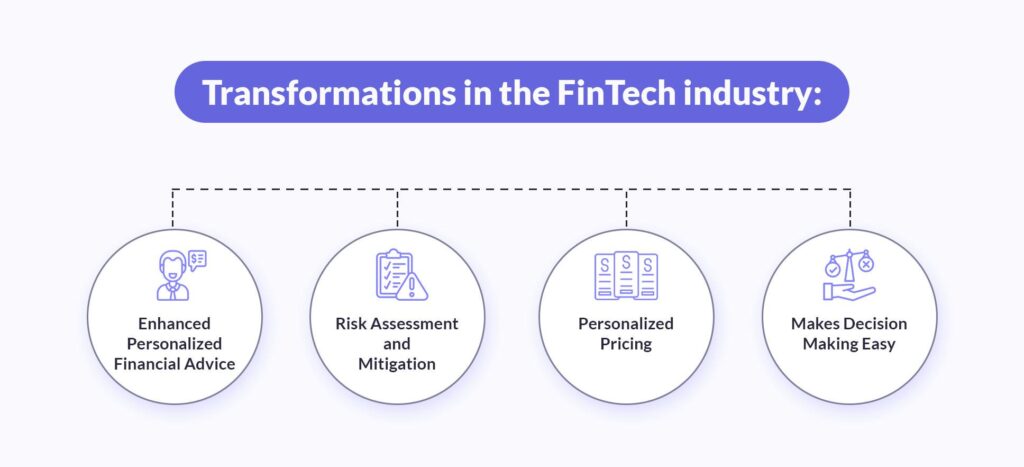

The monetary know-how sector is witnessing a monumental shift, propelled by the mixing of generative synthetic intelligence. Past mere developments, the appliance of generative AI, bolstered by skilled generative AI consulting providers, is setting new benchmarks in predicting real-life monetary outcomes with unprecedented precision.

These developments aren’t remoted developments however are a part of a broader motion in direction of clever, data-driven decision-making processes. As FinTech corporations navigate this advanced panorama, the demand for specialised steering in deploying generative AI options has surged, highlighting the essential position of companies like Geniusee in facilitating this transition.

Geniusee, a trailblazer within the realm of software program growth and AI consulting, is on the forefront of empowering FinTech companies to harness the ability of generative AI. By providing bespoke generative AI options, Geniusee is not only a service supplier however a strategic companion that permits corporations to innovate and excel in a extremely aggressive market. Their experience in generative AI consulting is instrumental in growing cutting-edge functions that improve fraud prevention, optimize asset administration, and refine credit score scoring strategies. This degree of assist is indispensable for FinTech corporations trying to leverage generative AI applied sciences successfully and sustainably.

Let’s delve into 5 paramount generative AI functions throughout the FinTech realm, showcasing their potential to raise operational effectivity and customer support. Let’s see!

1. Revolutionizing Fraud Detection and Prevention

In an period the place digital transactions are ubiquitous, the specter of monetary fraud looms massive. The worldwide marketplace for fraud detection and prevention, which stood at $29.5 billion in 2022, is on a trajectory to exceed $252 billion by 2032, as per Allied Market Analysis.

Generative AI is on the forefront of combating this menace by scrutinizing huge datasets for anomalies that trace at fraudulent actions. Its skill to adapt and be taught from new knowledge ensures that FinTech companies are all the time a step forward of cybercriminals. An illustrative instance is PayPal’s deployment of generative AI to dissect person actions and transaction knowledge, considerably enhancing its fraud detection mechanisms.

2. Reworking Credit score Scoring and Danger Evaluation

Correct danger evaluation and credit score scoring are the backbones of the lending trade. Generative AI is redefining this area by using deep studying to research market developments, spending patterns, and transaction histories. This nuanced method to credit score scoring permits for extra knowledgeable lending choices and a discount in monetary danger.

Crediture stands out as a pioneer on this house, leveraging generative AI to evaluate financial indicators and private monetary habits, thereby providing tailor-made lending choices that mirror a person’s true creditworthiness.

3. Enhancing Algorithmic Buying and selling

Algorithmic buying and selling has been revolutionized by generative AI, which automates buying and selling methods primarily based on complete analyses of market knowledge and developments. This innovation is especially evident within the foreign exchange market, the place algorithmic buying and selling constituted 92% of all trades in 2019.

By harnessing generative AI, companies like Bridgewater Associates have optimized their buying and selling algorithms, enhancing market prediction accuracy and operational effectivity. This shift not solely improves profitability but additionally introduces a degree of precision and velocity unattainable by human merchants.

4. Personalizing Monetary Companies

Generative AI is making personalised monetary providers a actuality for shoppers worldwide. In a panorama the place monetary nervousness is prevalent, the flexibility of AI to supply tailor-made recommendation on funding methods and danger administration is invaluable.

Purposes corresponding to Cleo, which make the most of generative AI, act as private monetary advisors, offering bespoke budgeting and funding suggestions. This degree of personalization ensures that people could make knowledgeable choices, lowering monetary stress and fostering a more healthy financial life-style.

5. Automating Regulatory Compliance and Reporting

Compliance with monetary rules is a big problem for FinTech corporations. Generative AI simplifies this course of by automating the evaluation of advanced authorized paperwork and monitoring regulatory updates in real-time. This functionality ensures that monetary establishments stay compliant with evolving requirements, thereby avoiding penalties and authorized points.

FintechOS exemplifies the appliance of generative AI in regulatory compliance, providing cloud-based options that assist establishments navigate the complexities of economic rules effectively and successfully.

The combination of generative AI into the FinTech trade signifies a leap in direction of extra clever, environment friendly, and personalised monetary providers. The experience of companies like Geniusee in generative AI consulting is essential in enabling companies to capitalize on these technological developments, making certain they not solely maintain tempo with but additionally lead within the quickly evolving monetary panorama.

As generative AI continues to mature, its functions inside FinTech will undoubtedly develop, additional driving innovation and excellence within the sector. The choice to cooperate with Geniusee presents FinTech corporations a useful partnership that guarantees not solely to navigate the complexities of AI integration but additionally to unlock a myriad of alternatives for development, innovation, and aggressive benefit. This collaboration embodies the merging of technological prowess with strategic imaginative and prescient, heralding a brand new period of economic options which might be as transformative as they’re indispensable!