Accounts receivable reconciliation is a vital course of inside accounting and monetary administration practices undertaken recurrently by a enterprise. As transactions with clients and shoppers happen, companies generate accounts receivable, which symbolize quantities owed to them for items and companies bought or rendered.

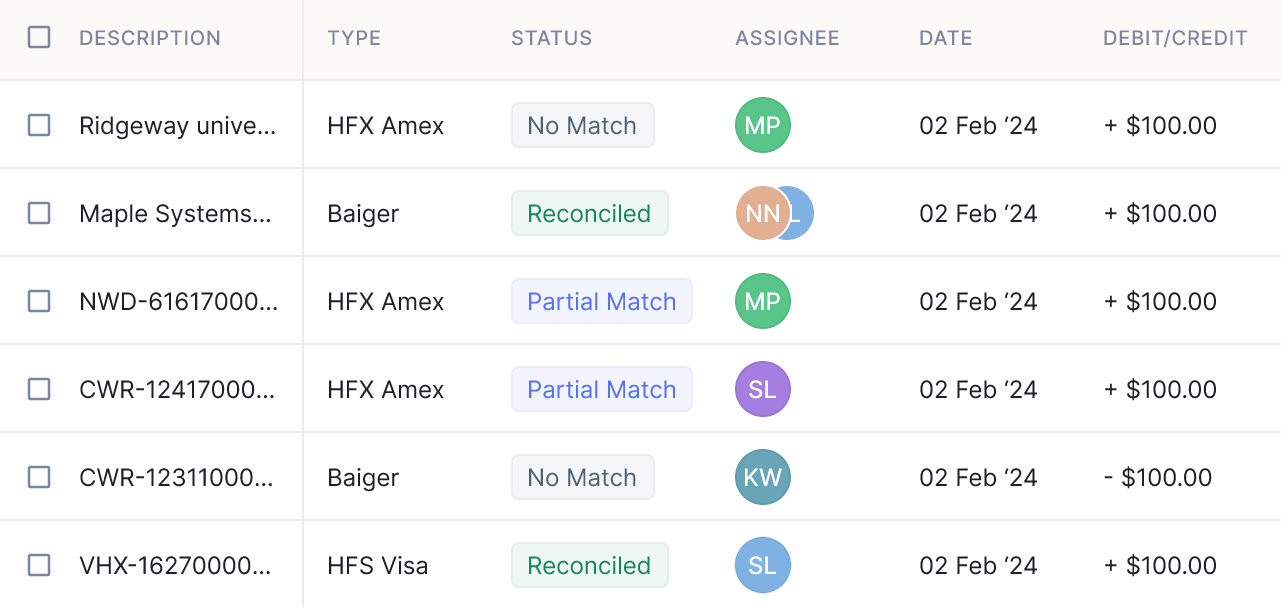

Reconciling accounts receivable entails evaluating the balances within the accounts receivable ledger with supporting documentation, comparable to invoices, receipts, and buyer funds. This course of helps establish discrepancies, resolve excellent balances, and preserve a transparent understanding of the corporate’s monetary place.

On this article, we’ll get into the intricacies of accounts receivable reconciliation, exploring its goal, key steps within the reconciliation course of, and the function of automation in streamlining this important monetary activity. Whether or not you are a seasoned accounting skilled or new to the sphere, understanding methods to successfully reconcile accounts receivable is important for making certain correct monetary reporting and optimising enterprise operations.

What’s Accounts Receivable Reconciliation?

Accounts receivable reconciliation is a elementary accounting course of that entails evaluating and verifying the balances within the accounts receivable ledger in opposition to supporting documentation and exterior information. This reconciliation goals to make sure the accuracy and completeness of accounts receivable transactions recorded within the firm’s monetary information.

The method of accounts receivable reconciliation is, at its core, about confirming the sum of money owed to the corporate by its clients or shoppers, and matching with the figures recorded within the accounting system. This entails cross-referencing varied sources of data, comparable to invoices, gross sales receipts, buyer funds, and ageing studies.

Throughout accounts receivable reconciliation, accounting professionals meticulously assessment every transaction to establish discrepancies, errors, or inconsistencies between the ledger balances and the supporting documentation. Any discrepancies discovered are investigated and resolved to keep up the integrity of the monetary information.

Accounts receivable reconciliation is crucial for a number of causes:

- Guaranteeing the accuracy of monetary statements: By reconciling accounts receivable, companies can confirm the reliability of their monetary studies, together with the stability sheet and earnings assertion.

- Figuring out and addressing discrepancies: Reconciliation helps uncover discrepancies between the quantities recorded within the ledger and the precise transactions, permitting companies to rectify errors and forestall monetary misstatements.

- Enhancing money circulate administration: Correct accounts receivable balances allow companies to raised handle their money circulate by making certain well timed assortment of excellent funds from clients.

- Facilitating decision-making: Dependable accounts receivable information gives useful insights into buyer cost tendencies, creditworthiness, and assortment efforts, empowering companies to make knowledgeable choices about credit score insurance policies, gross sales methods, and debt administration.

In abstract, accounts receivable reconciliation is a vital course of that ensures the accuracy, integrity, and reliability of an organization’s monetary information associated to buyer transactions. By systematically reviewing and verifying accounts receivable balances, companies can preserve monetary transparency, mitigate dangers, and optimise their monetary efficiency.

Step-by-Step Information to Accounts Receivable Reconciliation

The method of reconciling accounts receivable entails a number of steps to make sure the accuracy and completeness of the accounts receivable ledger. What follows is an in depth information to performing accounts receivable reconciliation:

- Collect Documentation: Begin by gathering all related documentation associated to accounts receivable transactions. This may increasingly embrace gross sales invoices, credit score memos, buyer funds, financial institution statements, and ageing studies.

- Assessment Gross sales Transactions: Examine the gross sales transactions recorded within the accounts receivable ledger with the corresponding gross sales invoices or gross sales orders. Confirm that every transaction is precisely recorded, together with the quantity, date, buyer title, and bill quantity.

- Confirm Buyer Funds: Cross-reference the shopper funds recorded within the accounts receivable ledger with the financial institution statements or cost receipts. Make sure that every cost is accurately utilized to the corresponding buyer account and bill.

- Reconcile Ageing Experiences: Assessment ageing studies to establish overdue invoices and excellent balances. Examine the ageing report totals with the accounts receivable ledger balances to substantiate accuracy.

- Examine Discrepancies: If any discrepancies or inconsistencies are recognized in the course of the reconciliation course of, examine the basis trigger. Widespread discrepancies could embrace unapplied funds, duplicate entries, or incorrect buyer balances.

- Regulate Ledger Balances: Make vital changes to the accounts receivable ledger to appropriate any errors or discrepancies. This may increasingly contain reversing incorrect entries, reclassifying transactions, or updating buyer account balances.

- Doc Reconciliation: Preserve detailed information of the reconciliation course of, together with any changes made and the explanations for these changes. Documentation is crucial for audit functions and making certain transparency in monetary reporting.

- Finalise Reconciliation: As soon as all discrepancies have been resolved and changes have been made, finalise the reconciliation course of. Make sure that the accounts receivable ledger balances match the supporting documentation and exterior information.

- Carry out Periodic Critiques: Recurrently assessment and reconcile accounts receivable balances to make sure ongoing accuracy and completeness. Month-to-month or quarterly reconciliations are really useful to remain up-to-date with buyer transactions and decrease discrepancies.

By following these steps, companies can successfully reconcile their accounts receivable balances, establish and tackle discrepancies, and preserve correct monetary information. This course of helps make sure the integrity of the accounts receivable ledger and allows companies to make knowledgeable choices primarily based on dependable monetary info.

Accounts Receivable Reconciliation

-

Collect Documentation: Gather all related paperwork (invoices, credit score memos, funds).

-

Assessment Gross sales: Confirm gross sales transactions within the ledger with gross sales invoices/orders.

-

Confirm Funds: Cross-reference funds with financial institution statements/receipts.

-

Reconcile Ageing Experiences: Verify overdue invoices and examine totals with the ledger.

-

Examine Discrepancies: Establish and resolve unapplied funds, duplicates, or errors.

-

Regulate Ledger: Appropriate errors by updating entries and balances.

-

Doc Course of: Maintain detailed information of all reconciliations and changes.

-

Finalise: Guarantee ledger balances match documentation and exterior information.

-

Periodic Critiques: Conduct month-to-month/quarterly reconciliations for accuracy.

When to Carry out Accounts Receivable Reconciliation

Performing accounts receivable reconciliation on the proper time is essential to sustaining correct monetary information and making certain the well timed assortment of excellent funds. There are some key milestones and intervals at which accounts receivable reconciliation ought to ideally be carried out:

Month-to-month Reconciliation: Conducting month-to-month accounts receivable reconciliation is crucial for staying on high of buyer transactions and figuring out any discrepancies or overdue invoices. By reconciling accounts receivable balances on the finish of every month, companies can promptly tackle points and preserve up-to-date monetary information.

Quarterly Critiques: Along with month-to-month reconciliations, performing quarterly evaluations of accounts receivable balances gives a chance to evaluate general efficiency and establish tendencies or patterns in buyer funds. Quarterly reconciliation helps companies monitor their progress in direction of income targets and tackle any underlying points affecting money circulate.

Yr-Finish Reconciliation: Yr-end accounts receivable reconciliation is especially vital for getting ready monetary statements and assessing the monetary well being of the enterprise. By reconciling accounts receivable balances on the finish of the fiscal yr, companies can guarantee compliance with regulatory necessities and precisely report their monetary place to stakeholders.

Earlier than Monetary Reporting: Accounts receivable reconciliation must also be carried out earlier than producing monetary studies or statements, comparable to earnings statements or stability sheets. Verifying the accuracy of accounts receivable balances ensures that monetary studies replicate the true monetary standing of the enterprise and supply stakeholders with dependable info for decision-making.

Following Important Occasions: Accounts receivable reconciliation must be performed following important occasions which will influence buyer transactions, comparable to mergers, acquisitions, or adjustments in enterprise operations. Reconciling accounts receivable balances after such occasions helps companies assess the influence on their monetary place and establish any changes wanted.

By performing accounts receivable reconciliation at these key intervals and milestones, companies can preserve correct monetary information, enhance money circulate administration, and successfully monitor buyer funds. Common reconciliation helps establish discrepancies early, tackle points promptly, and make sure the integrity of monetary reporting.

Examples of Accounts Receivable Reconciliation

Accounts receivable reconciliation entails evaluating the information of excellent buyer balances with the corresponding entries within the normal ledger. Listed here are some examples of widespread accounts receivable reconciliation situations:

- Matching Invoices with Funds: One widespread reconciliation activity is matching buyer funds with the corresponding invoices. Companies obtain funds from clients for items or companies rendered, and these funds must be precisely recorded and matched with the invoices they relate to. Accounts receivable reconciliation ensures that every cost is correctly allotted to the proper bill, stopping discrepancies in buyer account balances.

- Figuring out Overdue Invoices: Accounts receivable reconciliation additionally entails figuring out overdue invoices that haven’t been paid by clients inside the specified credit score phrases. By evaluating the ageing report of accounts receivable with the final ledger, companies can establish excellent invoices that require follow-up or assortment efforts. Reconciliation helps companies prioritise assortment efforts and cut back the chance of dangerous money owed.

- Resolving Discrepancies: Accounts receivable reconciliation could uncover discrepancies between the quantities recorded within the normal ledger and the precise buyer balances. These discrepancies may come up because of errors in recording transactions, posting errors, or buyer disputes. Reconciliation entails investigating and resolving such discrepancies to make sure the accuracy of monetary information and buyer account balances.

- Adjusting for Returns or Allowances: Companies may have to regulate accounts receivable balances to account for returns, allowances, or reductions granted to clients. Reconciliation entails figuring out such changes and making certain that they’re correctly recorded within the normal ledger. Changes for returns or allowances assist companies precisely replicate the online quantity owed by clients and preserve the integrity of monetary reporting.

- Reviewing Dangerous Debt Provisions: Accounts receivable reconciliation can also contain reviewing provisions for dangerous money owed or uncollectible accounts. Companies must assess the chance of non-payment by sure clients and make provisions for potential losses. Reconciliation helps companies assessment and regulate dangerous debt provisions primarily based on the ageing of accounts receivable and historic assortment patterns.

Total, accounts receivable reconciliation ensures the accuracy and completeness of buyer account balances, facilitates efficient money circulate administration, and helps knowledgeable decision-making concerning credit score and assortment insurance policies. By reconciling accounts receivables recurrently, companies can preserve monetary stability and mitigate dangers related to excellent buyer balances.

This is an instance of accounts receivable reconciliation utilizing a simplified desk format:

On this instance, to reconcile accounts receivable, we begin with the overall bill quantity and deduct the funds obtained to calculate the remaining stability. This is how the reconciliation course of is finished for every bill:

- INV-001: $500 – $0 = $500

- INV-002: $750 – $500 = $250

- INV-003: $1,000 – $1,000 = $0

- INV-004: $600 – $400 = $200

- INV-005: $900 – $0 = $900

After reconciling all invoices, we calculate the overall quantities:

- Complete Bill Quantity: $3,750

- Complete Cost Acquired: $1,900

- Complete Remaining Stability: $1,850

This reconciliation course of ensures that the overall bill quantity matches the sum of funds obtained plus the remaining stability, thereby verifying the accuracy of accounts receivable information. Any discrepancies will be recognized and investigated additional to keep up correct monetary information.

How Automation Improves Accounts Receivable Reconciliation

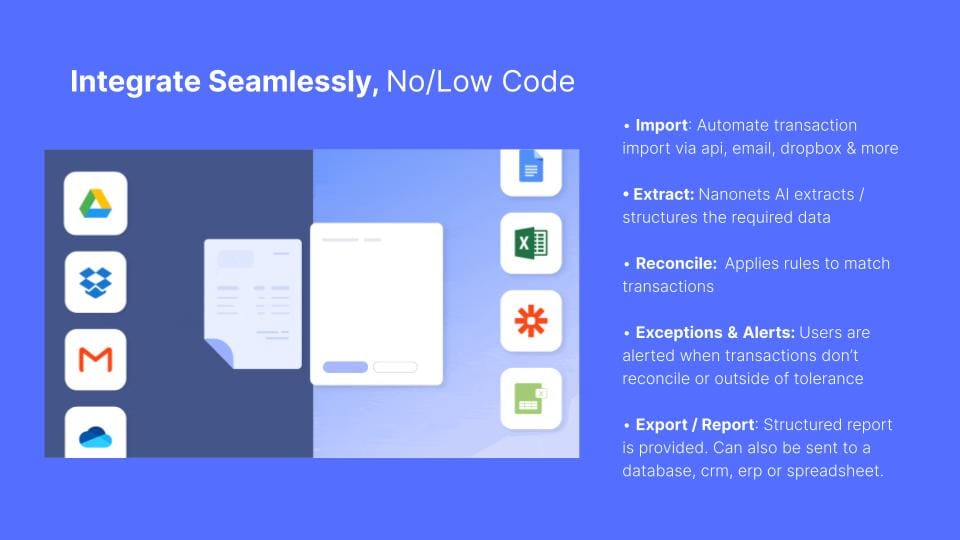

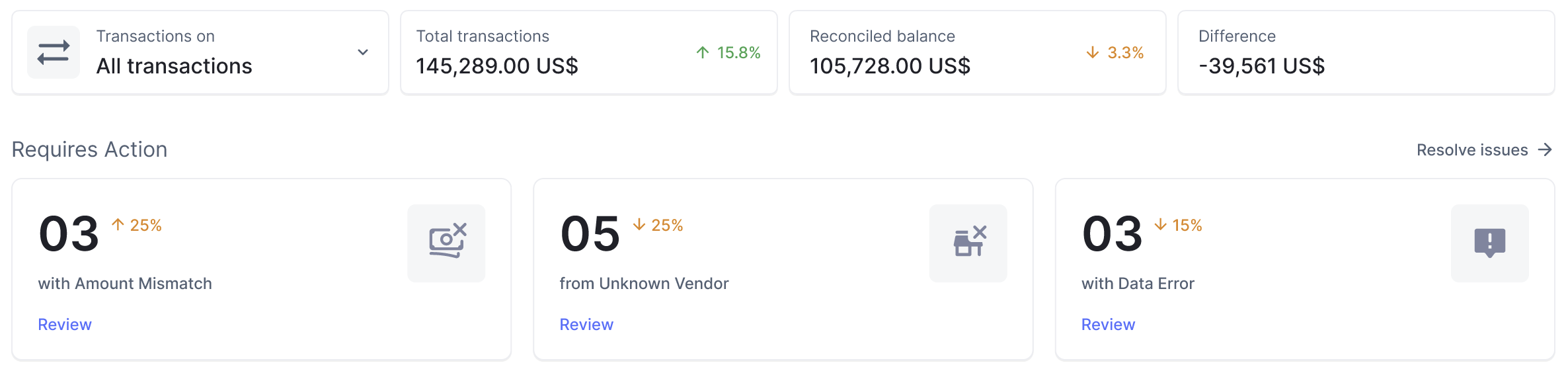

Automation instruments like AI/ML-enabled Nanonets can considerably streamline the accounts receivable reconciliation course of by automating repetitive duties and decreasing guide errors. This is how:

- Automated Information Extraction: Nanonets can extract information from invoices, receipts, and cost paperwork with excessive accuracy AI/ML-enabled OCR (Optical Character Recognition) expertise. This eliminates the necessity for guide information entry, saving time and decreasing errors.

- Matching and Reconciliation: Nanonets can robotically match funds obtained with corresponding invoices utilizing superior algorithms. This ensures that every one transactions are precisely reconciled with out the necessity for guide intervention.

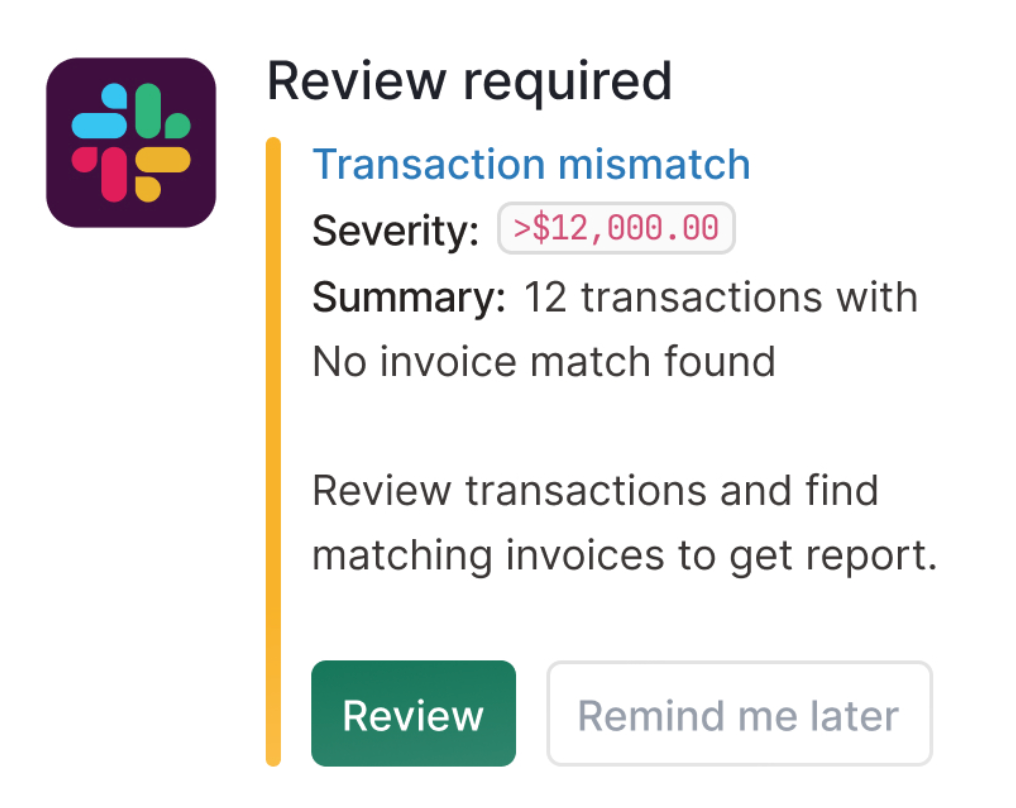

- Exception Dealing with: Nanonets can flag and prioritise exceptions, comparable to discrepancies between invoices and funds or lacking paperwork, for assessment by finance groups. This enables groups to focus their consideration on resolving vital points whereas decreasing the chance of overlooking necessary discrepancies.

- Integration with Accounting Methods: Nanonets seamlessly integrates with accounting methods and ERP (Enterprise Useful resource Planning) software program, permitting for real-time updates and synchronisation of reconciled information. This ensures that monetary information are at all times up-to-date and correct.

- Reporting and Analytics: Nanonets gives complete reporting and analytics capabilities, permitting finance groups to realize insights into accounts receivable efficiency, establish tendencies, and make data-driven choices. This helps enhance general monetary administration and forecasting.

By leveraging automation instruments like Nanonets, companies can streamline the accounts receivable reconciliation course of, cut back guide effort, and guarantee better accuracy and effectivity in monetary operations.

Conclusion

Accounts receivable reconciliation is a vital course of for companies to make sure the accuracy and integrity of their monetary information. By reconciling invoices and funds recurrently, companies can establish discrepancies, monitor excellent balances, and preserve wholesome money circulate.

On this article, we have explored the idea of accounts receivable reconciliation, its significance, and the steps concerned within the reconciliation course of. We have additionally mentioned how automation instruments like Nanonets can streamline the reconciliation course of, saving time and decreasing errors.

By adopting greatest practices and leveraging automation expertise, companies can optimise their accounts receivable reconciliation course of, enhance monetary effectivity, and make extra knowledgeable enterprise choices.