Monetary paperwork are normally laden with complicated numerical knowledge and really particular terminology and jargon, which presents a problem for current Pure Language Processing (NLP) fashions. These fashions require superior capabilities for numerical processing and a deep understanding of this jargon to precisely interpret and leverage the wealth of knowledge in these paperwork. The speedy tempo of monetary markets provides one other layer of complexity, necessitating real-time evaluation for efficient decision-making. Monetary paperwork usually function numerous forms of visible content material, demanding multimodal processing talents to completely exploit their potential for producing actionable insights and market intelligence.

Current developments in monetary NLP have been marked by the event of specialised fashions like FinBERT, which paved the way in which for extra subtle methods, together with BloombergGPT, PIXIU, Instruct-FinGPT, and GPT-FinRE. These fashions have been designed to deal with the distinctive challenges of monetary language, from sentiment evaluation to occasion extraction and funding technique enhancement. Improvements have additionally prolonged to multimodal capabilities with FinVis-GPT and rigorous mannequin analysis frameworks like FinLMEval and DISCFinLLM. Regardless of these developments, a urgent want stays to handle additional points, resembling stopping info hallucination and enhancing numerical reasoning in monetary NLP fashions.

A staff of researchers from the College of British Columbia & Invertible AI have launched a groundbreaking Massive Language Mannequin (LLM), FinTral, tailor-made for the monetary sector. FinTral employs a multimodal method, processing textual, numerical, tabular, and visible knowledge to navigate the complexities of monetary paperwork. It introduces FinSet, a complete benchmark for evaluating monetary LLMs. It demonstrates exceptional capabilities, together with a model with enhanced imaginative and prescient and gear retrieval features, outperforming established fashions like GPT-4 in quite a few duties.

Constructing on the foundational introduction of FinTral, this mannequin stands out by integrating a multimodal method, leveraging textual, numerical, tabular, and visible knowledge for an enriched monetary doc evaluation. Using the bottom Mistral-7b mannequin, FinTral undergoes additional domain-specific pretraining on the expansive FinSet dataset, comprising 20 billion tokens collected from numerous sources resembling C4, information, and monetary filings. To refine its understanding and responsiveness to monetary queries, it advantages from instruction tuning and AI-driven suggestions, incorporating human and AI suggestions to reinforce efficiency. FinTral integrates visible knowledge processing by way of CLIP encoders and employs instruments for numerical duties, successfully augmenting its capabilities. The mannequin’s effectiveness is additional amplified by Direct Coverage Optimization and Retrieval Augmented Technology, enabling it to deal with the complexities of monetary evaluation with unprecedented accuracy and depth.

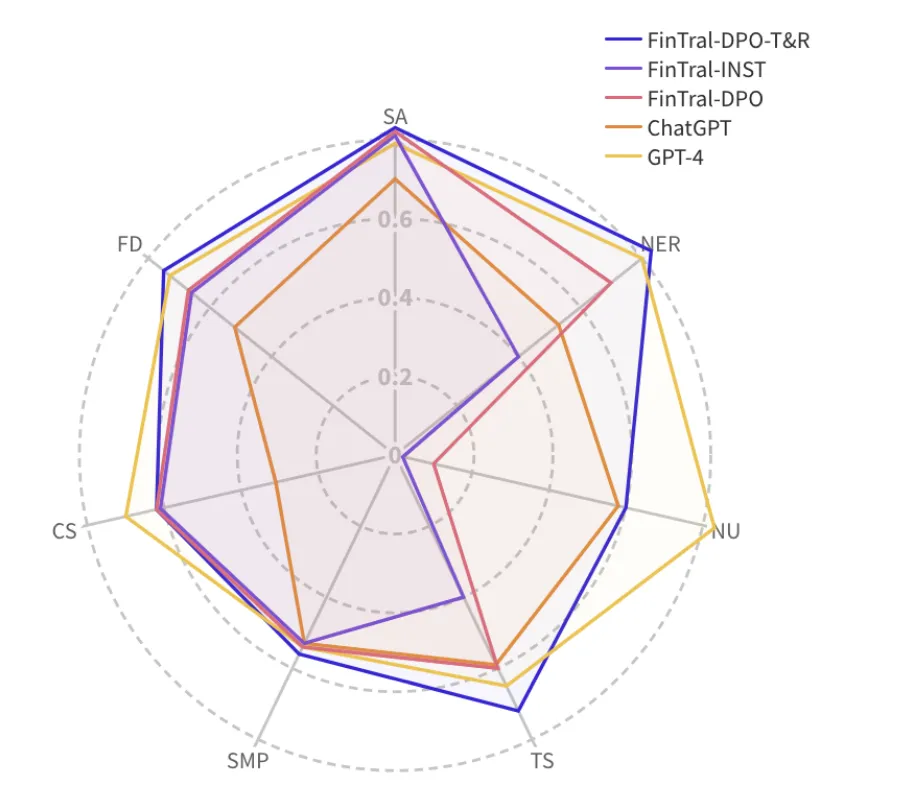

Experiments reveal FinTral’s distinctive efficiency throughout varied monetary duties, quantitatively surpassing many up to date fashions. The mannequin FinTral-INST, obtained by fine-tuning the pre-trained mannequin, outperformed all different fashions with a median rating of 0.49. Fashions that underwent reinforcement studying with AI suggestions confirmed marked enhancements, with FinTral-DPO outperforming ChatGPT. FinTral-DPO mannequin demonstrates distinctive efficiency with a median rating of 0.59. This rating signifies its superior capabilities, putting it just under GPT-4’s common rating of 0.69. Nevertheless, with these outcomes, there’s nonetheless a set of scopes for enchancment, together with however not restricted to real-time knowledge dealing with, upkeep and updating, shortage of annotated knowledge, and so forth.

In conclusion, FinTral is a sophisticated monetary language mannequin leveraging intensive datasets and numerous coaching strategies to investigate complicated monetary knowledge. It reduces mannequin hallucinations by pretraining with clear monetary knowledge and using retrieval strategies, enhancing accuracy and reliability. Its real-time adaptability to monetary markets and dynamic knowledge retrieval can considerably enhance predictive accuracy and decision-making. The researchers acknowledge the constraints and danger elements concerned within the analysis and are optimistic in regards to the future developments this work may pave the way in which for.

Take a look at the Paper. All credit score for this analysis goes to the researchers of this venture. Additionally, don’t overlook to observe us on Twitter and Google Information. Be a part of our 38k+ ML SubReddit, 41k+ Fb Group, Discord Channel, and LinkedIn Group.

For those who like our work, you’ll love our publication..

Don’t Overlook to hitch our Telegram Channel

You may additionally like our FREE AI Programs….

Nikhil is an intern marketing consultant at Marktechpost. He’s pursuing an built-in twin diploma in Supplies on the Indian Institute of Know-how, Kharagpur. Nikhil is an AI/ML fanatic who’s all the time researching purposes in fields like biomaterials and biomedical science. With a robust background in Materials Science, he’s exploring new developments and creating alternatives to contribute.