Welcome to our newest weblog put up, the place we embark on a deep dive into the intricacies of the Normal Ledger (GL) — the bedrock of any enterprise’s monetary system.

We are going to begin with the fundamentals: What precisely is a Normal Ledger, and why is it paramount to your small business’s monetary well being? We’ll unravel the Chart of Accounts, the spine of the GL, detailing how transactions are organized and recorded.

We’ll additionally discover the way to effectively handle and make the most of your Normal Ledger, together with the implementation of contemporary software program options to automate and streamline your accounting processes. In an period the place effectivity and accuracy are paramount, harnessing expertise to handle your Normal Ledger could be a game-changer.

Whether or not you are a small enterprise proprietor, a finance skilled, a CFO, or just curious concerning the monetary operations of a enterprise, this weblog sequence guarantees to equip you with an intensive understanding of the Normal Ledger, its significance and it is efficient implementation inside a enterprise.

What’s a Normal Ledger?

At its core, a basic ledger is a whole file of all monetary transactions that happen inside an organization over its lifetime. This meticulous doc serves as the muse for an organization’s monetary statements, categorizing and recording every transaction. By this rigorous group, it supplies a vital snapshot, providing a complete view of the corporate’s monetary well being and facilitating detailed monetary evaluation and reporting.

Let’s perceive this intimately.

Chart of Accounts

The overall ledger is organized right into a Chart of Accounts that replicate an organization’s monetary transactions throughout varied classes. These major accounts are vital in portray a complete image of an organization’s monetary well being and embody belongings, liabilities, fairness, income, and bills.

- Property are sources owned by the corporate which have financial worth and will be transformed into money. Examples embody money, stock, and property.

- Liabilities symbolize the corporate’s obligations or money owed that it should pay to different entities. These will be loans, accounts payable, or mortgages.

- Fairness refers back to the proprietor’s claims after subtracting liabilities from belongings, basically representing the web belongings owned by the shareholders.

- Income accounts monitor the revenue generated from the corporate’s operations, like gross sales and providers.

- Bills account for the prices incurred in producing income, together with prices like hire, utilities, and salaries.

Sub-Categorization

Inside every essential class, a enterprise can create customized subcategories that replicate the nuances of it is operations. Under is an instance of a framework with potential subcategories. Click on on every class and subcategory to discover additional.

Money and Money Equivalents

Accounts Receivable

Stock

Pay as you go Bills

Property, Plant, and Tools (PP&E)

Intangible Property

Shares, bonds, or actual property

Accounts Payable

Accrued Bills

Brief-term Loans

Lengthy-term Loans

Deferred Tax Liabilities

Bonds Payable

Capital

Retained Earnings

Widespread Inventory

Most well-liked Inventory

Gross sales Income

Service Income

Curiosity Revenue

Rental Revenue

Dividend Revenue

Value of Items Offered (COGS)

Payroll

Hire

Utilities

Advertising and marketing and Promoting

Insurance coverage

Depreciation and Amortization

Curiosity Expense

Losses from Asset Gross sales

By embracing element inside every essential GL account, you create a sturdy system that precisely displays your small business operations. Nonetheless, bear in mind the precept of avoiding overcomplication: tailor your subcategories to match the particular wants and scale of your small business, guaranteeing that your GL account construction stays each helpful and manageable.

GL Coding

Normal Ledger Codes, or GL Codes, are distinctive alphanumeric strings that classify and file monetary transactions inside an organization’s basic ledger into corresponding GL account. Every GL account is related to corresponding GL code. These codes function the basic constructing blocks of a enterprise’s monetary construction, enabling the categorization of transactions into distinct accounts for revenues, bills, belongings, liabilities, and fairness. As an example, a GL code for workplace provides expense helps be certain that all expenditures associated to workplace provides are grouped collectively, facilitating simpler monitoring and evaluation.

The Division of Justice permits using a five-digit community for every sector (major account class) to make sure there are sufficient particular person identification numbers to incorporate subcategorization.

- Property—10000 sequence

- Liabilities—20000 sequence

- Internet belongings—30000 sequence

- Revenues—40000 sequence

- Bills—50000 sequence

When designing your GL codes, think about the next:

- Degree of Element: Decide the granularity of knowledge you want. Whereas element is efficacious, an excessive amount of can overwhelm your system and customers.

- Sub Account Codes: In case your constitution of accounts has subcategorization past the 5 classes, create GL code ranges for the subcategories. (eg. inside “Property” account with GL codes in 10000 sequence, create subcategories comparable to 10000-11000 for “present belongings”, 11000-12000 for “mounted belongings”. Additional categorization may imply that inside 10000-11000 for “present belongings”, we assign 10000-10300 for “Accounts Receivable”, 10300-10600 for “Pay as you go Bills”, 10600-10999 for “Stock”.)

As soon as your classes, subcategories and GL codes are arrange, you’ve gotten successfully constructed your chart of accounts. This is an snippet of what a Chart of Accounts may finally appear to be.

| ID | Identify | ID | Identify | Kind | Aspect |

|---|---|---|---|---|---|

| 1010 | Gross sales – Shopper Electronics | 10 | Gross sales | Revenue | Cr |

| 1020 | Gross sales – House Home equipment | 10 | Gross sales | Revenue | Cr |

| 1030 | Gross sales – Workplace Tools | 10 | Gross sales | Revenue | Cr |

| 1040 | Gross sales – Cell Gadgets | 10 | Gross sales | Revenue | Cr |

| 1050 | Gross sales – IT Options | 10 | Gross sales | Revenue | Cr |

| 1060 | Gross sales – Wearable Tech | 10 | Gross sales | Revenue | Cr |

| 1070 | Gross sales – Software program Options | 11 | Gross sales | Revenue | Cr |

| 1080 | Gross sales – Service Contracts | 10 | Gross sales | Revenue | Cr |

| 1090 | Gross sales – Technical Assist | 10 | Gross sales | Revenue | Cr |

| 2000 | Curiosity Acquired | 15 | Curiosity | Revenue | Cr |

| 2010 | Consulting Revenue | 16 | Providers | Revenue | Cr |

| 2020 | Miscellaneous Revenue | 17 | Different Revenue | Revenue | Cr |

| 2030 | Dividend Revenue | 17 | Different Revenue | Revenue | Cr |

| 2040 | Acquire on Funding Sale | 17 | Different Revenue | Revenue | Cr |

| 3000 | COGS – Shopper Electronics | 20 | Value of Gross sales | Value of Items | Dr |

| 3010 | COGS – House Home equipment | 20 | Value of Gross sales | Value of Items | Dr |

| 3020 | COGS – Workplace Tools | 20 | Value of Gross sales | Value of Items | Dr |

| 3030 | COGS – Cell Gadgets | 20 | Value of Gross sales | Value of Items | Dr |

| 3040 | COGS – IT Options | 20 | Value of Gross sales | Value of Items | Dr |

| 3050 | COGS – Wearable Tech | 20 | Value of Gross sales | Value of Items | Dr |

| 3060 | COGS – Software program Options | 21 | Direct Prices | Value of Items | Dr |

| 3070 | COGS – Service Contracts | 20 | Value of Gross sales | Value of Items | Dr |

| 3080 | COGS – Technical Assist | 20 | Value of Gross sales | Value of Items | Dr |

| 4000 | Wages – Manufacturing Workers | 22 | Wages | Different Prices | Dr |

| 4010 | Wages – Gross sales Staff | 22 | Wages | Different Prices | Dr |

| 4020 | Wages – Administrative Workers | 22 | Wages | Different Prices | Dr |

| 4030 | Wages – Analysis & Improvement | 22 | Wages | Different Prices | Dr |

| 4040 | Wages – IT Assist Workers | 22 | Wages | Different Prices | Dr |

| 4050 | Wages – Govt Salaries | 22 | Wages | Different Prices | Dr |

Now that we perceive the chart of accounts, let’s discover the way to use the system to populate the overall ledger and file transactions in it as they occur.

Double-Entry Bookkeeping

Every transaction recorded within the basic ledger is entered as both a debit or a credit score, based mostly on the double-entry bookkeeping system. This technique ensures that for each transaction, a corresponding and reverse entry is made to a different account, sustaining the accounting equation’s stability.

💡

Contemplate a small café that buys a brand new espresso machine for $1,000. Within the Normal Ledger, this transaction impacts two accounts: the café will increase its “Tools” account (Asset) by $1,000 (debit) and reduces its “Money” account (Asset) by $1,000 (credit score). This retains the accounting equation balanced, as the rise in tools belongings is offset by a lower in money belongings. It is a sensible instance of how each enterprise transaction is recorded within the Normal Ledger to replicate the true monetary state of the enterprise precisely.

Debits and credit have an effect on the accounts otherwise; for example, debits enhance belongings and bills however lower liabilities and fairness, whereas credit have the alternative impact. This methodology of recording transactions ensures the accuracy and integrity of monetary info, offering a transparent and balanced view of the corporate’s monetary standing.

Instance of a Normal Ledger

Given under is an occasion of an accounting system with a basic ledger for a fictitious account, ABCDEFGH Software program.

- The leftmost part within the occasion above is the length of the transaction.

- To its proper is the journal entry quantity correlated with the transaction, which incorporates an figuring out amount correlated with the transaction.

- The reason of the transaction is within the following column. It asserts the explanation behind the transaction. For this occasion, a given transaction is for a financial fee from a buyer account to ABCDEFGH Software program. Because the cash account is acquiring revenue, then the debit part will present a achieve and show an quantity for the quantity. On this case, it’s $10,000.

- For this transaction, the credit score part will keep intact for this account. Nonetheless, a definite ledger entry for the company’s accounts receivable will point out a credit score deduction for a similar quantity, as a result of ABCDEFGH Software program now not has that proportion receivable from its buyer.

To retain the accounting equation’s net-zero discrepancy, one asset account should improve whereas one other reduces by an identical quantity. The latest stability for the money account, after the web change from the transaction, will then be mirrored within the stability class.

Recording Transactions

The realm of GL accounting is operated by debits and credit. Debits and credit create a e-book’s world go ‘spherical. You have to doc debits and credit for every transaction.

Comply with the three golden legal guidelines of accounting whereas recording transactions –

1. Debit the receiver and credit score the giver

The regulation of debiting the receiver and crediting the giver arrives on the present with private reviews. A private account is a basic ledger pertaining to individuals or establishments. In case you acquire one thing, debit the account. In case you present one thing, credit score the account.

To illustrate you purchase $1,000 value of commodities from Firm XYZ in your editions, you require to debit your Buy Account and credit score Firm XYZ. As a result of the supplier, Firm XYZ, is giving items, you’re required to credit score Firm XYZ. Then, you require to debit the receiver, that’s your Buy Account.

2. Debit what arrives in and credit score what courts

For precise accounts, use this golden rule. Actual accounts are additionally known as sturdy accounts. Actual accounts don’t shut at year-end. Somewhat, their proportions are carried over to the next accounting interval. An actual account is claimed to be an asset account, an fairness account, or a legal responsibility account. Actual accounts additionally comprise contra belongings, fairness, and legal responsibility accounts. With an actual account, each time one thing arrives in your organization (e.g., an asset), debit the account. Additionally, when one thing leaves out of your organization, credit score the account.

Say you purchased furnishings for $2,500 in cash. Debit your Furnishings Account (what arrives in) and credit score your Money Account (what leaves out).

3. Debit bills and losses, credit score revenue and positive factors

The final word golden rule of accounting pacts with nominal accounts. A nominal account is claimed to be an account that you simply shut on the finish of every accounting length. Nominal accounts are additionally known as momentary accounts. Nominal or momentary accounts comprise income, achieve, expense and loss accounts. In nominal accounts, debit the account if your organization has a loss or expense. Credit score your account if your organization must doc revenue or achieve.

To illustrate you purchase $3,000 of commodities from Firm ABC. To doc the transaction, it’s best to debit the expenditure ($3,000 buy) and credit score the income.

To illustrate you promote $1,700 commodities to Firm ABC. It’s best to credit score the income in your Gross sales Account and debit the expenditure.

Why is Normal Ledger Necessary?

The overall ledger is an in depth file of all financial transactions adjusted for the lifetime of your agency.

The phrase “retaining the books” infers to retaining a basic ledger, the primary accounting file in your firm should you use double-entry bookkeeping. It’s the basic device that allows you to maintain a hint of all transactions and kind them into subcategories so your accountant can find a summarized, complete file of your organization funds multi function space.

The overall ledger performs an important function in your organization’s monetary operations, performing as a complete repository. Consider it as a central hub that holds all of the monetary info wanted to arrange your organization’s monetary statements. It’s constructed upon foundational paperwork, with a minimum of one journal entry corresponding to every monetary transaction. These foundational paperwork may very well be invoices or cancelled checks, serving as proof of the transactions recorded.

Listed here are six justifications that the overall ledger is so vital for your small business:

- Mortgage utility: Lenders will constantly ask for a mix of financial information if your organization pertains for a mortgage. Your basic ledger can allow you to immediately find and determine no matter information you want.

- Balancing your books: A basic ledger means that you can full a trial stability. This allows you to stability the books.

- Prepared for an Audit: If one is audited by the IRS (Inner Income Service), will probably be easy to formulate the audit since your financial information are multi function spot.

- Fraud detection: It allows you to extra effortlessly place fraud or another drawback together with your books since it’s easy to look by means of and comprehend.

- Inner and exterior communication: The overall ledger retains all the info important to supply your financial statements for each administration, or inside use and exterior, or investor or shopper use.

- Tax Compliance and Advantages: The GL ensures that each penny of revenue and expense is accounted for, making tax submitting much less of a headache. Furthermore, it might assist determine potential tax deductions and credit, guaranteeing you are not leaving cash on the desk. Within the realm of enterprise, the place each greenback counts, these tax advantages could make a big distinction in your backside line.

Normal Ledger vs Normal Journal

The overall journal, also known as the e-book of authentic entry, serves as the first step within the accounting course of. Every transaction is recorded in chronological order, offering an in depth narrative of each monetary exercise. This makes the overall journal an important useful resource for anybody in search of perception into particular entries. That is how basic journal entries appear to be –

| Date | Particulars | L.F. | Debit ($) | Credit score ($) |

|---|---|---|---|---|

| 02/01/24 | Workplace Provides – XYZ Model, Account #123456 | 101 | 150.00 | |

| 02/02/24 | Service Income – Contracted Providers, Account #789012 | 102 | 300.00 | |

| 02/03/24 | Hire Expense – Workplace House, Account #345678 | 103 | 800.00 | |

| 02/04/24 | Financial institution Mortgage – ABC Financial institution, Mortgage #987654 | 104 | 5000.00 |

Conversely, the overall ledger, or accounting ledger, is the spine of the accounting system. It is the place the double-entry bookkeeping takes place, with every transaction affecting two accounts: one debit and one credit score. The overall ledger consolidates information from varied journals into related accounts, making it simpler to arrange monetary statements and assess the monetary well being of a enterprise. That is how basic ledger entries appear to be –

| Date | GL Code | Class | Subcategory | Reference | Debit ($) | Credit score ($) | Operating Stability ($) |

|---|---|---|---|---|---|---|---|

| 02/01/24 | 10011 | Property | Workplace Provides | INV-001 | 150.00 | 150.00 | |

| 02/02/24 | 40201 | Income | Service Income | SRV-002 | 300.00 | 150.00 | |

| 02/03/24 | 50101 | Bills | Working Bills | RENT-003 | 800.00 | 650.00 | |

| 02/04/24 | 20001 | Liabilities | Loans Payable | LOAN-004 | 5000.00 | 5650.00 |

Key Variations are –

- Performance: The overall journal is the start line for all transactions, with every transaction recorded in descriptive chronological kind to make sure readability and ease of studying. The overall ledger, nevertheless, is the place these transactions are summarized into non-descriptive structured accounts, facilitating the method of monetary assertion preparation.

- Double-Entry Bookkeeping: Whereas the journal information transactions in chronological order with out the need of balancing debits and credit for every entry, the ledger is the place double-entry bookkeeping comes into play, necessitating that each debit has a corresponding credit score.

- Objective and Use: The journal is used for recording the detailed narrative of each transaction, serving as a complete reference. The ledger’s goal is to mixture this info, making it simpler to investigate and interpret monetary information at scale.

How one can Implement a Normal Ledger in your Enterprise

Step one in choosing the proper basic ledger system is an intensive evaluation of your small business’s dimension and complexity. Whether or not you are operating a small native enterprise or a multinational company, the amount of transactions and the operational complexity will considerably affect your system necessities. A system that is too primary may not deal with the complexity, whereas an excessively subtle system may overwhelm and decelerate processes. It is essential to strike the correct stability, guaranteeing the system aligns with your small business’s scale and operational wants.

With this in thoughts, you possibly can discover and discover the correct Normal Ledger software program for you based mostly on the options you want. Under guidelines covers a broad spectrum of options that companies ought to think about when evaluating basic ledger methods.

Core Accounting Options

- Chart of Accounts: Customizable accounts for recording transactions.

- Journal Entries: Guide and computerized entry capabilities.

- Monetary Statements: Era of stability sheets, revenue statements, and money circulation statements.

- Financial institution Reconciliation: Instruments to match financial institution transactions with GL entries.

- Accounts Payable (AP): Administration of payments and funds to distributors.

- Accounts Receivable (AR): Monitoring of buyer invoices and receipts.

Compliance and Reporting

- Audit Trails: Data of adjustments to information for transparency and compliance.

- Tax Administration: Assist for varied tax charges and jurisdictions.

- Multi-Forex Assist: Dealing with of transactions in a number of currencies.

- Regulatory Compliance: Options to make sure compliance with monetary laws.

Scalability and Flexibility

- Modular Construction: Add-on modules for extra performance.

- Customization Choices: Capability to tailor the system to particular enterprise wants.

- Consumer Entry Administration: Management over person permissions and entry ranges.

- Scalability: Capability to deal with development in transaction quantity and complexity.

Integration and Information Administration

- Third-Get together Integrations: Compatibility with different enterprise software program (CRM, ERP, and so forth.).

- Information Import/Export: Instruments for shifting information to and from the system.

- Doc Administration: Storage and retrieval of monetary paperwork.

- Backup and Restoration: Mechanisms for information backup and restoration.

Superior Options

- Budgeting and Forecasting: Instruments for setting monetary objectives and predicting outcomes.

- Challenge Accounting: Monitoring of financials for particular tasks.

- Stock Administration: Oversight of inventory ranges, orders, and gross sales.

- Fastened Property Administration: Monitoring of firm belongings and depreciation.

Consumer Expertise and Accessibility

- Dashboard and Analytics: Visible representations of monetary information for insights.

- Cell Entry: Capability to entry the GL system through cell units.

- Consumer Interface: Ease of use and intuitive navigation.

- Customized Reporting: Instruments to create and customise monetary reviews.

Safety and Reliability

- Information Safety: Encryption and safe information storage.

- Consumer Authentication: Safe login processes.

- Uptime Ensures: Dedication to system availability.

- Assist and Upkeep: Entry to buyer help and system updates.

Value and Funding

- Preliminary Setup Prices: Bills related to organising the system.

- Subscription Charges: Ongoing prices for utilizing the software program.

- Customization Prices: Bills for extra customization.

- Coaching and Implementation: Prices for coaching employees and implementing the system.

Check out the under sources to check one of the best Normal Ledger Software program available in the market proper now –

For Small and Medium Companies:

- The Greatest Accounting Software program for Small Companies in 2024.

- QuickBooks On-line is commonly highlighted as one of the best total possibility, appreciated for its scalability, complete function set, and robust buyer help. It is appropriate for a variety of small companies.

- Wave is acknowledged for its worth, providing a powerful set of primary options free of charge, making it supreme for startups and really small companies with easy accounting wants.

- FreshBooks stands out for small service-based companies, providing sturdy undertaking accounting options, wonderful buyer help, and ease of use.

- Zoho Books presents nice cell accounting capabilities and is beneficial for companies that prioritize accessibility and integration with different Zoho apps.

For Enterprises:

Greatest Accounting Software program for Enterprise Companies

For bigger enterprises, trying into choices that provide superior performance, comparable to Oracle NetSuite and Sage, can be useful. These options usually help a wider vary of enterprise processes past accounting, comparable to ERP, CRM, and e-commerce.

Trade-Particular Wants:

The selection of accounting software program may also rely in your particular business wants. For instance,

- FreshBooks is beneficial for service-based companies resulting from its undertaking administration and time monitoring options.

- Companies in retail or manufacturing may search for software program with sturdy stock administration options, comparable to QuickBooks On-line or Zoho Books.

- MARG ERP 9+ Accounting caters to the distinctive necessities of healthcare corporations with options for billing, stock administration, monetary reporting, pharmacy stock administration, and affected person file monitoring.

- Q7 is constructed particularly for the trucking business, Q7 presents a full suite of accounting instruments together with payroll, basic ledger, accounts receivable, and accounts payable. It’s famous for its sturdy order administration function, which features a citation device to trace and convert quotations to orders.

- Premier Building Software program (previously Jonas Premier) is right for big building business companies with its undertaking administration capabilities and real-time price updates. Nonetheless, its pricing could also be difficult for smaller companies or startups. On the identical time, Sage 100 Contractor is finest for building microbusinesses, providing scalability, digital instruments for basic ledgers, accounts receivable and payable, and full help for payroll and time monitoring. It is famous for its extra inexpensive pricing and construction-specific performance.

In conclusion, evaluating one of the best basic ledger software program entails

- consideration of your monetary scale,

- guaranteeing required options are current, and

- ensuring the software program is suitable with the operational processes and compliance calls for of your particular business.

💡

Demos, trials, and opinions play an important function on this decision-making course of, offering insights and hands-on expertise with the software program earlier than making a dedication.

Automate your Normal Ledger

The overall ledger is the spine of your organization’s monetary information. It’s the centralized repository for all monetary information, together with belongings, liabilities, fairness, income, and bills. Managing this manually, particularly in a digital ledger, will not be solely time-consuming but additionally vulnerable to human error. As companies scale, the amount of transactions will increase exponentially, making handbook administration an unsustainable follow.

The shortcomings are as follows –

- Time-Consuming Information Entry: Guide entry is not only sluggish; it is a drain on sources, pulling employees away from extra value-added actions.

- Error-Susceptible Transactions: The human issue introduces a margin for error in information entry, resulting in discrepancies that may cascade by means of monetary reporting.

- Inefficient Approval Workflows: Conventional processes typically contain cumbersome approval chains that delay funds and complicate money circulation administration.

- Cumbersome Books-Shut Course of: The method of closing books will be laborious and complicated, typically requiring intensive handbook reconciliation and adjustment.

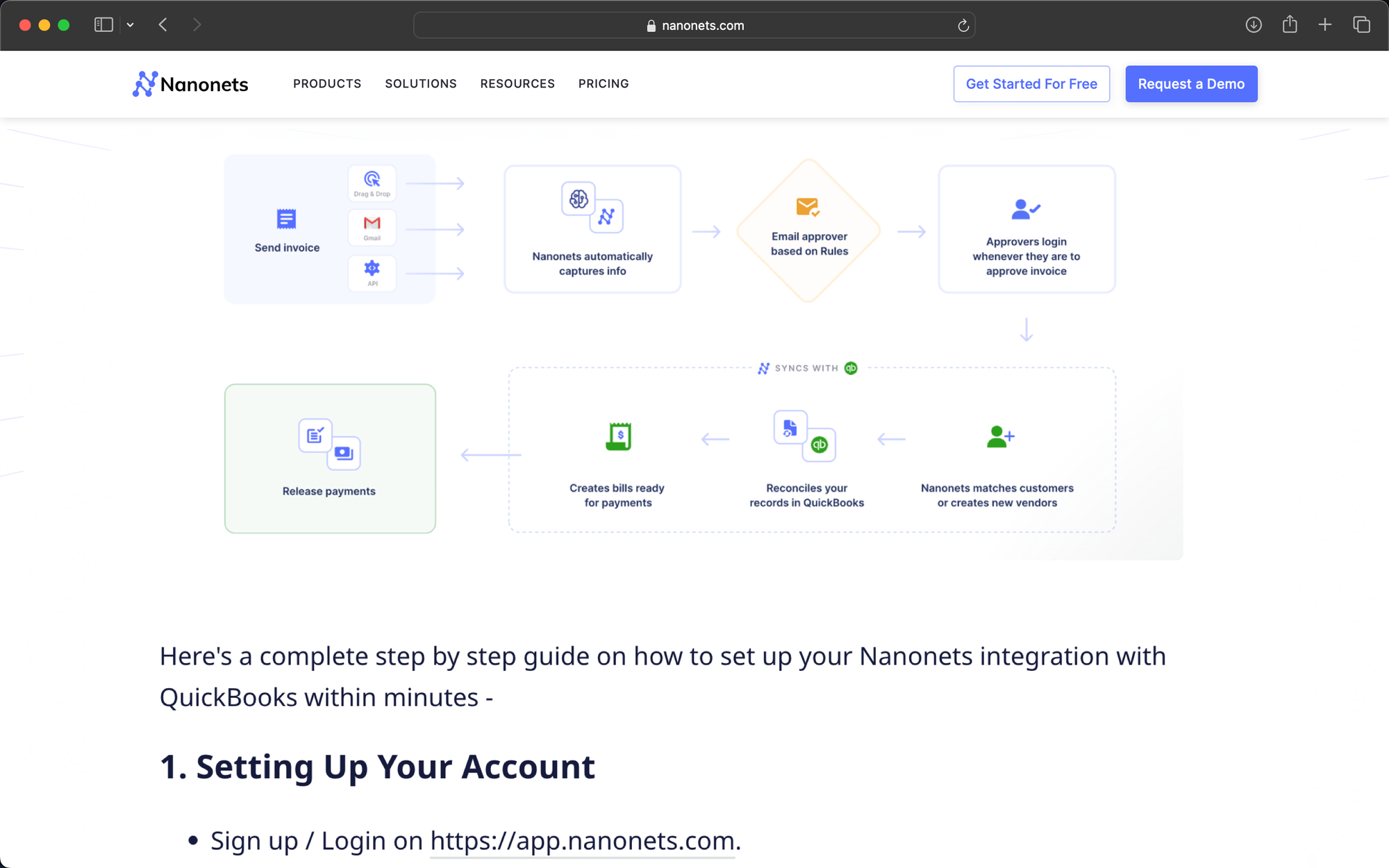

Accounting automation software program at present alleviates these challenges by using synthetic intelligence and workflow automation. These automation software program can work with different accounting methods; many methods have varied integration choices, comparable to API or middleware, to offer seamless information switch between the completely different methods. This manner, automation software program can retrieve information comparable to invoices and buy orders from different accounting methods, course of them after which replace the knowledge within the exterior accounting platform.

With the mixing, companies can reap the benefits of the accounting automation software program’s capabilities, whereas nonetheless utilizing the accounting software program that they’re snug with. Nanonets’ accounting automation software program, for instance, will be built-in with different accounting methods, comparable to QuickBooks and Sage.

Let’s examine how automation alleviates the challenges of manually managing your basic ledgers.

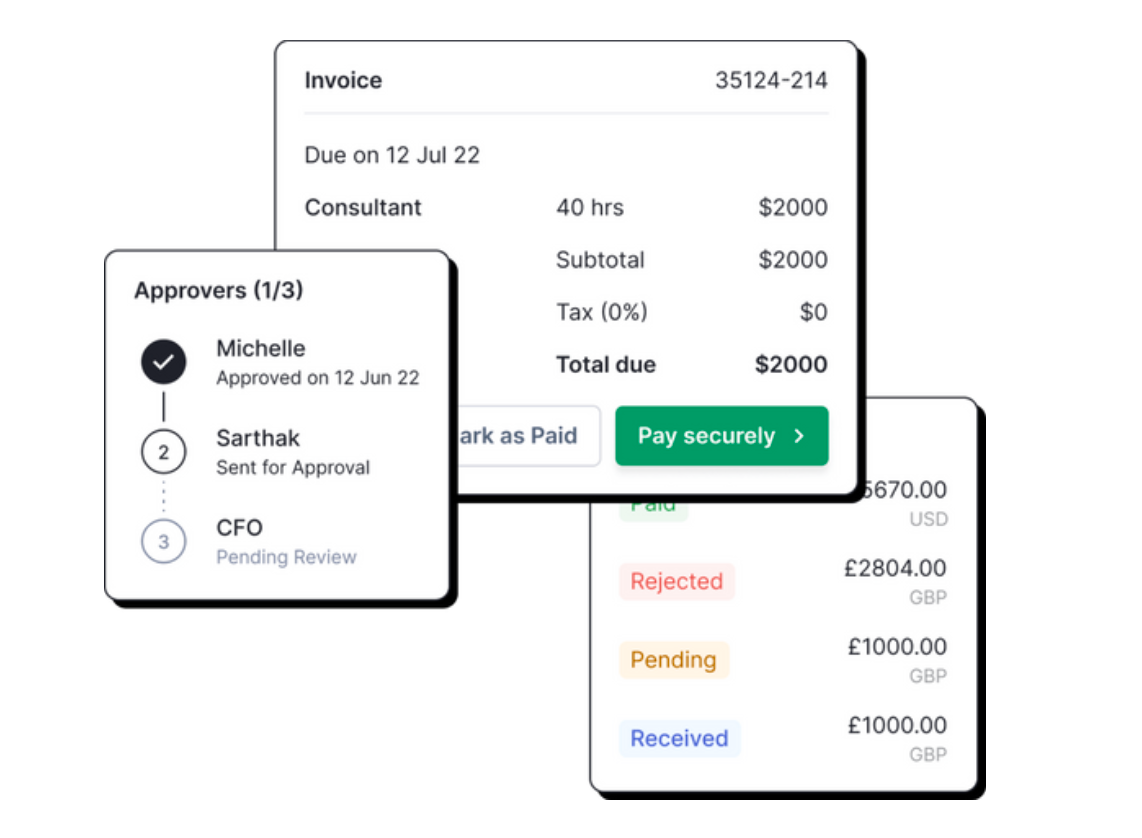

Automated Bill Assortment

Think about a world the place all of your bill and receipt assortment efforts converge harmoniously into one central hub. You will bid farewell to the times of sifting by means of emails, shared drives, vendor portals, and outdated databases. As an alternative, welcome a streamlined vacation spot the place each bill, no matter its origin, is collected mechanically.

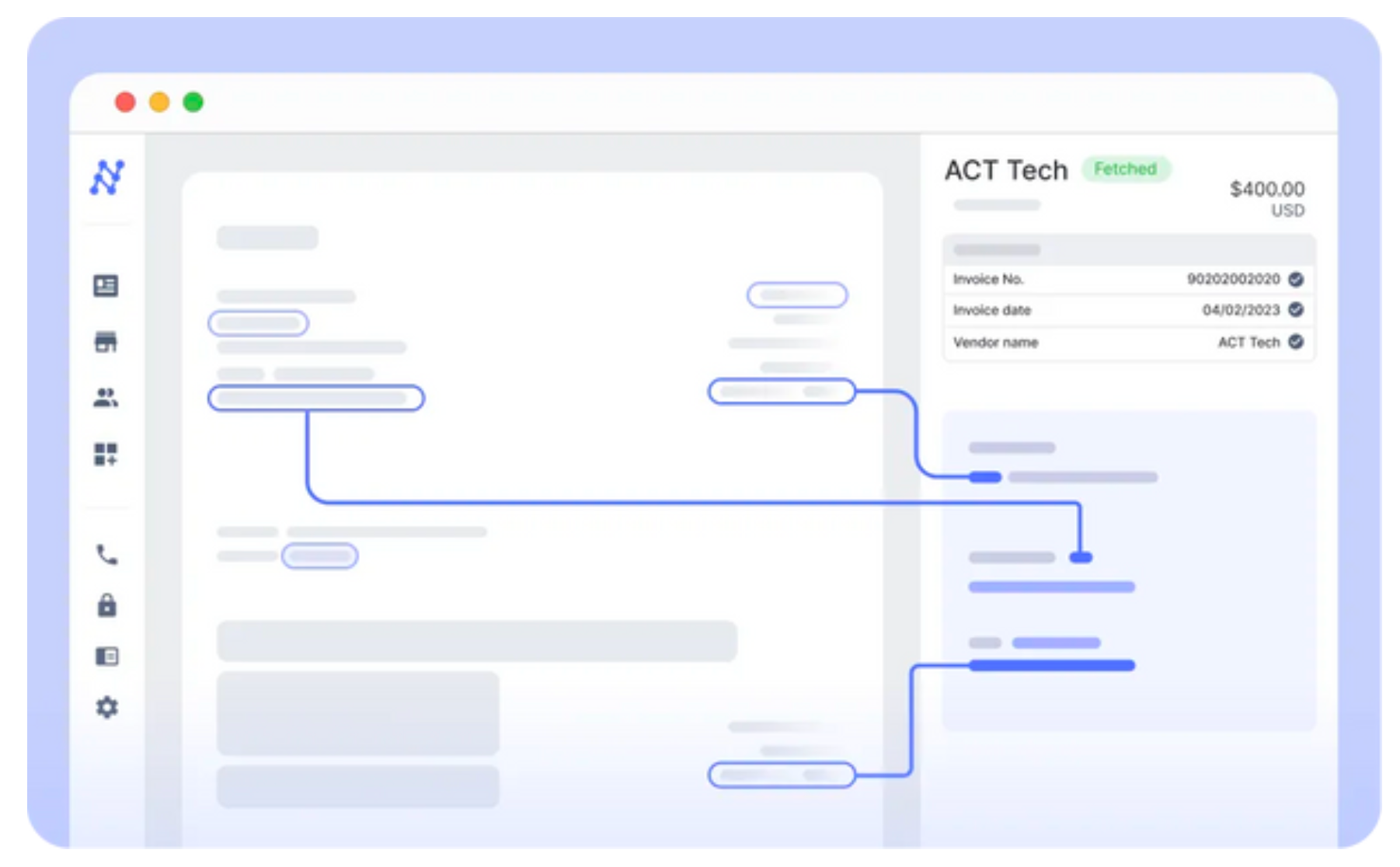

Automated Information Entry

Information entry is commonly the bane of effectivity, nevertheless it would not must be. Accouting automation software program at present brings to the desk AI-powered Information Extraction that boasts a powerful 99%+ accuracy charge. This implies your invoices, receipts and buy orders are learn and processed with out the painstaking effort of handbook entry. The hours and even days of labor this might save your group are invaluable. It is the type of change that makes your group wish to come to work within the morning, realizing they will give attention to duties that really want their experience.

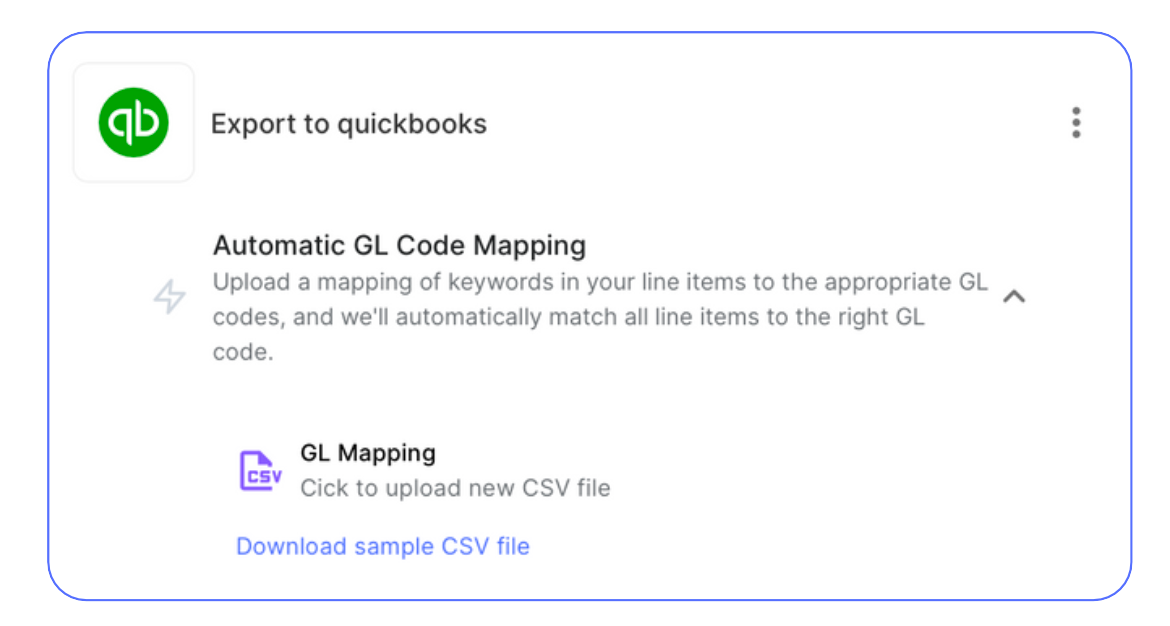

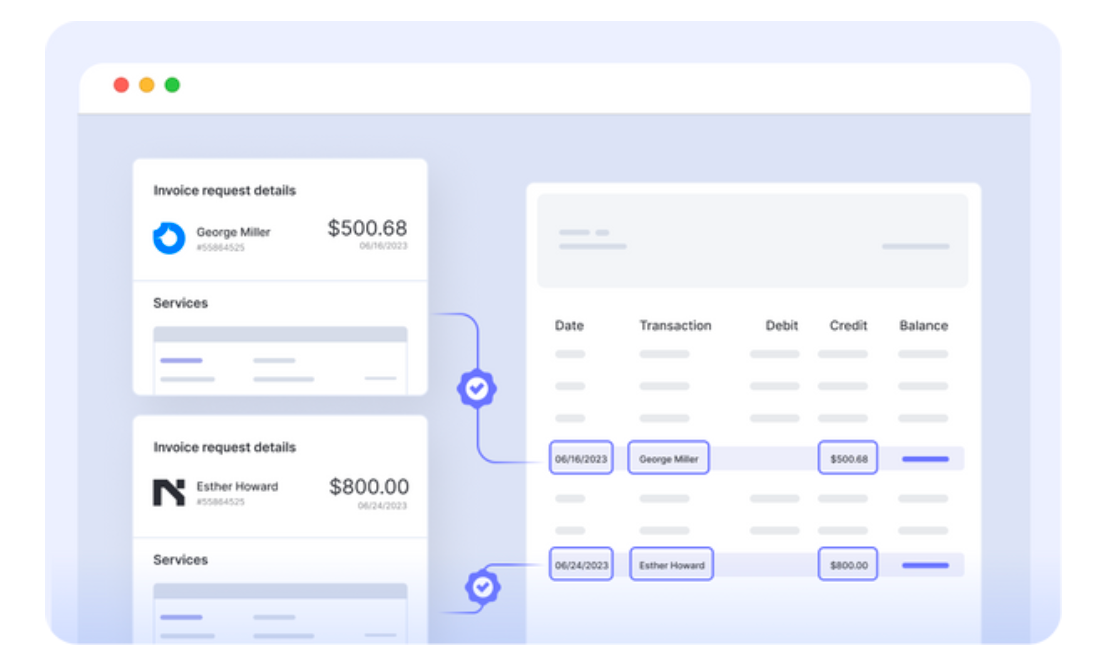

Automated Normal Ledger Information Export & Coding

The extracted information is seamlessly exported to your accounting software program’s Normal Ledger in real-time. Furthermore, coding these exported GL entries will be extraordinarily tedious and error-prone. Superior AI methods like NLP and LLM are right here to deal with the grunt work. By automating GL coding together with information export, your division can work smarter, not more durable, and make sure the group’s efforts abilities are used the place they’re most wanted.

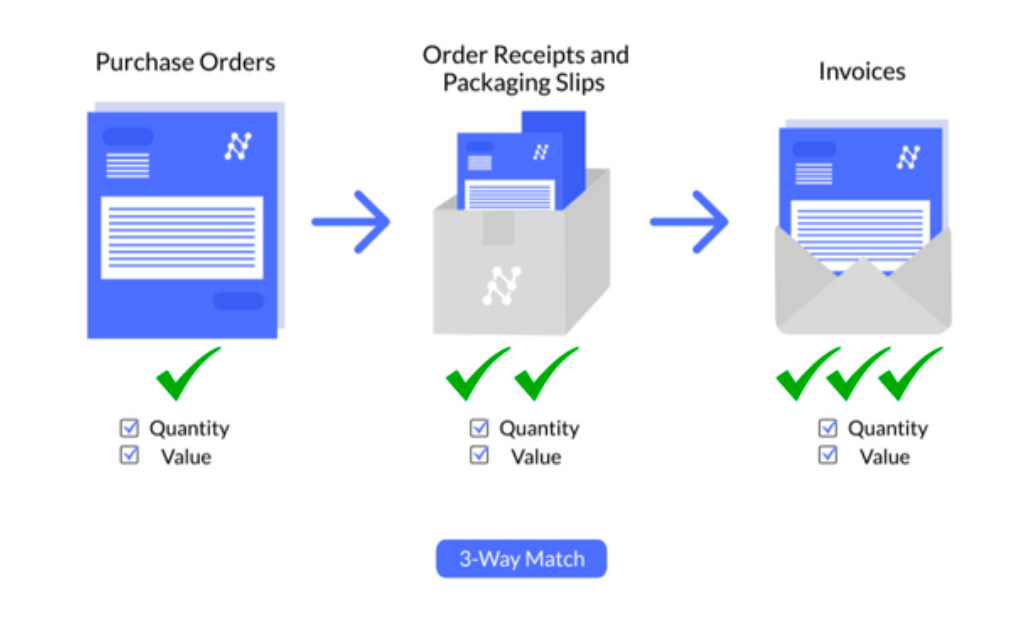

Enhancing Accuracy with Automated Verification

The magic of Automated 3-way matching can’t be overstated. Integrating invoices, buy orders, and supply notes reduces each the time spent and the potential for errors—no extra chasing down discrepancies or sending numerous follow-up emails. This technique handles the verification course of with such precision that it seems like having an additional set of infallible eyes.

Simplifying Processes with Straightforward Approvals

Workflow automation means approvals are now not a bottleneck. They grow to be versatile and dwell the place your group does—whether or not that is on electronic mail, Slack, or Groups. This eliminates the necessity for disruptive telephone calls and the all-too-familiar barrage of reminders. Your approval course of turns into as agile as your group, adapting to the circulation of your every day operations seamlessly.

Mastering Funds with Computerized Reconciliation

Lastly, let’s discuss closing the books. Computerized reconciliation transforms this typically arduous job, matching financial institution transactions with ledger entries in a fraction of the time it used to take. What as soon as took days can now be executed in minutes. Think about closing your month-to-month books with such velocity and precision you can virtually hear the collective sigh of reduction out of your group.

Nanonets for GL Automation

Integrating Nanonets into your present basic ledger can revolutionize the best way you deal with your GL processes. By leveraging the facility of Nanonets, you possibly can seamlessly automate bill assortment, information entry, information export, coding, verification, approvals, and reconciliation. This not solely saves time but additionally considerably reduces the margin for error, guaranteeing your monetary information is correct and up-to-date.

Join on app.nanonets.com.

Now, you possibly can –

Day 0: Begin a Dialog

Schedule a name at your comfort to debate your wants with our automation specialists, and so they’ll present a customized Nanonets demo.

Day 1: Assess your Wants

We are going to consider your present accounting course of, pinpoint how Nanonets could make the largest affect, guaranteeing our resolution aligns together with your objectives.

Day 2: Setup and Customization

We’ll information you on utilizing Nanonets. You will arrange & automate your accounting workflow fitted to you based mostly on our dialogue.

Day 3: Testing

After setup, take a look at your workflow with actual information throughout a typical 7-day trial (extendable on request). Our group will help in fine-tuning your workflow.

Day 7: Buy & Go Dwell

After profitable testing, we’ll suggest a tailor-made, cost-effective pricing plan. When you’re pleased with it, we’ll go dwell!

Endlessly: Empowering your Staff

We offer sources, periods, and steady customer support to make sure your group’s adoption, proficiency and confidence.

Buyer Tales

From small enterprises to multinational companies, these tales showcase the transformative affect of accounting automation with Nanonets throughout industries.

SaltPay: Streamlining Vendor Administration with SAP Integration

Trade: Fee Providers and Software program

Location: London, England

Problem: SaltPay confronted the daunting job of manually dealing with hundreds of invoices, which was each impractical and inefficient for managing their intensive vendor community.

Resolution: Nanonets stepped in with its AI-powered device for bill information extraction, seamlessly integrating with SAP. This integration not solely enhanced information accuracy but additionally considerably improved course of effectivity.

Outcomes: The implementation led to a 99% discount in handbook effort, enabling SaltPay to handle over 100,000 distributors effectively. This drastic enchancment has additionally led to a big enhance in productiveness and automation capabilities.

Tapi: Automating Property Upkeep Invoicing

Trade: Property Upkeep Software program

Location: Wellington, New Zealand

Problem: With over 100,000 month-to-month invoices, Tapi wanted a scalable and environment friendly resolution for bill administration in property upkeep.

Resolution: Using Nanonets’ AI device, Tapi automated bill information extraction, facilitating fast integration with current methods that may very well be maintained by non-technical employees.

Outcomes: The method time was decreased from 6 hours to simply 12 seconds per bill, alongside a 70% price saving in invoicing and attaining 94% automation accuracy.

Professional Companions Wealth: Automating Accounting Information Entry in Quickbooks

Trade: Wealth Administration and Accounting

Location: Columbia, Missouri

Problem: Professional Companions Wealth sought to enhance the accuracy and effectivity of knowledge entry for invoicing, as current automation instruments fell quick.

Resolution: Nanonets supplied a tailor-made resolution with exact information extraction and integration capabilities with QuickBooks, enabling streamlined invoicing and automatic information validation.

Outcomes: The accuracy of knowledge extraction exceeded 95%, with a 40% time saving in comparison with conventional OCR instruments and an over 80% Straight By Processing charge, minimizing the necessity for handbook intervention.

Augeo: Advancing Accounts Payable Automation on Salesforce

Trade: Accounting and Consulting Providers

Location: United States

Problem: Augeo wanted an environment friendly accounts payable resolution that might combine seamlessly with Salesforce, to handle hundreds of month-to-month invoices with out the heavy burden of handbook processing.

Resolution: Nanonets supplied an AI-driven platform tailor-made for automated bill processing, facilitating straightforward integration with Salesforce for environment friendly information administration.

Outcomes: The answer decreased bill processing time from 4 hours to half-hour every day, achieved an 88% discount in handbook information entry time, and processed 36,000 invoices yearly with heightened accuracy and effectivity.

These buyer tales illustrate the broad applicability and vital advantages of accounting automation with Nanonets. By leveraging AI-powered instruments and seamless integrations, corporations usually are not solely optimizing their GL processes but additionally paving the best way for broader operational excellence. The journey of those organizations underscores the potential of accounting automation to revolutionize monetary operations, driving effectivity, accuracy, and development throughout industries.