Xero is an accounting software program appropriate for small to medium-sized companies in search of a sturdy cloud-based accounting resolution. The platform simplifies monetary administration, offering real-time visibility of economic positions and efficiency. But, regardless of its superior capabilities, managing accounts payable and bill processing manually in Xero is changing into an increasing number of difficult.

The challenges are quite a few:

- painstakingly gradual guide information entry

- ever-present threat of human error

- lack of effectivity within the approval course of

Companies are continually in search of methods to streamline these crucial operations. In the present day, AP automation expertise can automate what was as soon as a laborious course of. When paired with Xero accounting software program suites in the marketplace, the mixing of AP Automation software program turns into a necessity for companies aiming for effectivity and accuracy. Nanonets integration with Xero represents a leap ahead in managing monetary transactions, setting a brand new customary for operational effectivity within the digital age. Let’s examine how this works, and how one can set this up on your groups.

The Evolution of Bill Processing

The journey of bill processing from its conventional, guide roots to the digital frontier is a story of technological evolution.

Pre Eighties: Handbook Accounts Payable

Accounts payable processes had been totally guide, involving bodily invoices, paper checks, and ledger books.

Eighties-Nineties: Digital Ledgers

Early software program options offered primary digital ledger capabilities, streamlining some elements of the method.

2000s: Digital Invoicing Unlocked

The web revolutionized accounts payable, introducing digital invoicing, on-line transactions, and e mail communications. This period noticed a major discount in paper-based processes.

2010s: Straightforward-to-use Cloud Options

Cloud-based options allowed for extra scalable, versatile, and accessible monetary operations, whereas cellular expertise enabled on-the-go bill administration and approvals.

Late 2010s-Current: Automated Accounts Payable Options

The newest evolution includes the usage of automation and synthetic intelligence to automate the complete course of together with –

- Accounting and AP Intelligence: The arrival of AI-based accounting programs has ushered in a brand new period of effectivity. Able to performing repetitive duties reminiscent of information entry, bill matching, and transaction processing, these programs function with a velocity and accuracy past human capabilities.

- Related Workflow Throughout Apps: In at this time’s interconnected digital panorama, seamless communication between purposes is essential. Emails, AP instruments, accounting software program, ERPs, and different databases now function in live performance, automating information seize and synchronization throughout platforms.

- Clever Knowledge Seize: Leveraging AI applied sciences like pure language processing and optical character recognition (OCR), at this time’s programs automate the extraction and interpretation of information from numerous bill codecs. This contains dealing with unstructured and scanned information with unprecedented effectivity, making the accounts payable course of smoother and extra correct than ever earlier than.

OCR Know-how for Bill Scanning

OCR (Optical Character Recognition) simplifies how companies deal with paperwork. In our use case, OCR scans invoices and different paper paperwork, turning them into digital textual content. The digital textual content is interpreted utilizing AI and bill particulars are extracted –

- Fields (bill date, bill quantity, quantity, vendor particulars, purchaser particulars, and many others)

- Line Gadgets (descriptions and prices of the Items and Providers Bought).

- GL Codes (robotically assigned by AI primarily based on previous information).

- Different dimensions primarily based on context (expense categorization, and many others.)

What impression does OCR and Bill Scanning Software program have?

Numerous reported statistics underscore the impression of automation software program. These numbers characterize a story of the sort of success that you simply and your staff can sit up for experiencing.

Dramatic Value Reductions in Processing

Let’s begin with the monetary well being of your division. AP Automation has been proven to slash processing prices by a staggering 70%. This is not nearly saving pennies; it is about reallocating your finances in direction of progress, coaching, and perhaps even that workplace espresso machine everybody’s been eyeing. Consider this as an funding in each your staff’s effectivity and their well-being.

Time is of the Essence

Now, think about decreasing your bill processing time by 384%. This dramatic lower means your staff can course of extra invoices quicker than ever earlier than, releasing up time to concentrate on strategic initiatives that actually matter. With AP Automation, “I haven’t got time for that” turns into “What’s subsequent on the agenda?”

Error Discount for Peace of Thoughts

We all know errors will be extra than simply annoying—they are often expensive. With a 37% discount in bill processing errors, AP Automation brings peace of thoughts to your operations. Fewer errors imply fewer hours spent in correction cycles and extra confidence in your information integrity. This additionally interprets into much less friction with distributors and stakeholders, smoothing the way in which for smoother relationships and operations.

Cultivating Vendor Relationships

Talking of relationships, let’s speak in regards to the 76% of organizations reporting elevated vendor satisfaction. That is key. Blissful distributors imply a dependable provide chain and alternatives for negotiations and reductions down the highway. Your distributors will discover and recognize the punctuality and accuracy of your funds, due to AP Automation.

Money Stream Optimization by Early Cost Reductions

A 3% financial savings by early fee reductions offers your group a monetary facelift, enhancing your money move, and offering you with extra leverage and suppleness in your monetary operations.

Compliance With out the Problems

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age the place regulatory calls for are ever-increasing, attaining full compliance with out the stress is nothing in need of miraculous.

Nanonets for OCR and Bill Scanning in Xero

For corporations using Xero for his or her accounting wants, the guide strategy of dealing with invoices is not only a check of persistence but in addition a major drain on assets. An OCR and Bill Scanning Software program for Xero transforms this crucial but cumbersome course of right into a streamlined, environment friendly workflow.

Let’s check out how accounting groups can use an OCR-based AP automation software program like Nanonets and combine it with Xero to streamline their accounting workflow.

Handbook AP Workflow in Xero

Let’s stroll by the everyday guide AP course of for an organization utilizing Xero:

Bill Receipt: Invoices arrive in numerous codecs, together with paper and digital. Employees should manually accumulate and arrange these paperwork.

Handbook Sorting and GL Coding: Every bill is then sorted primarily based on standards reminiscent of vendor, quantity, or due date, requiring important effort and time. Every bill should then be coded to the suitable Common Ledger accounts.

Knowledge Entry: Vital data from every bill, reminiscent of vendor particulars, quantities, and dates, is manually entered into Xero.

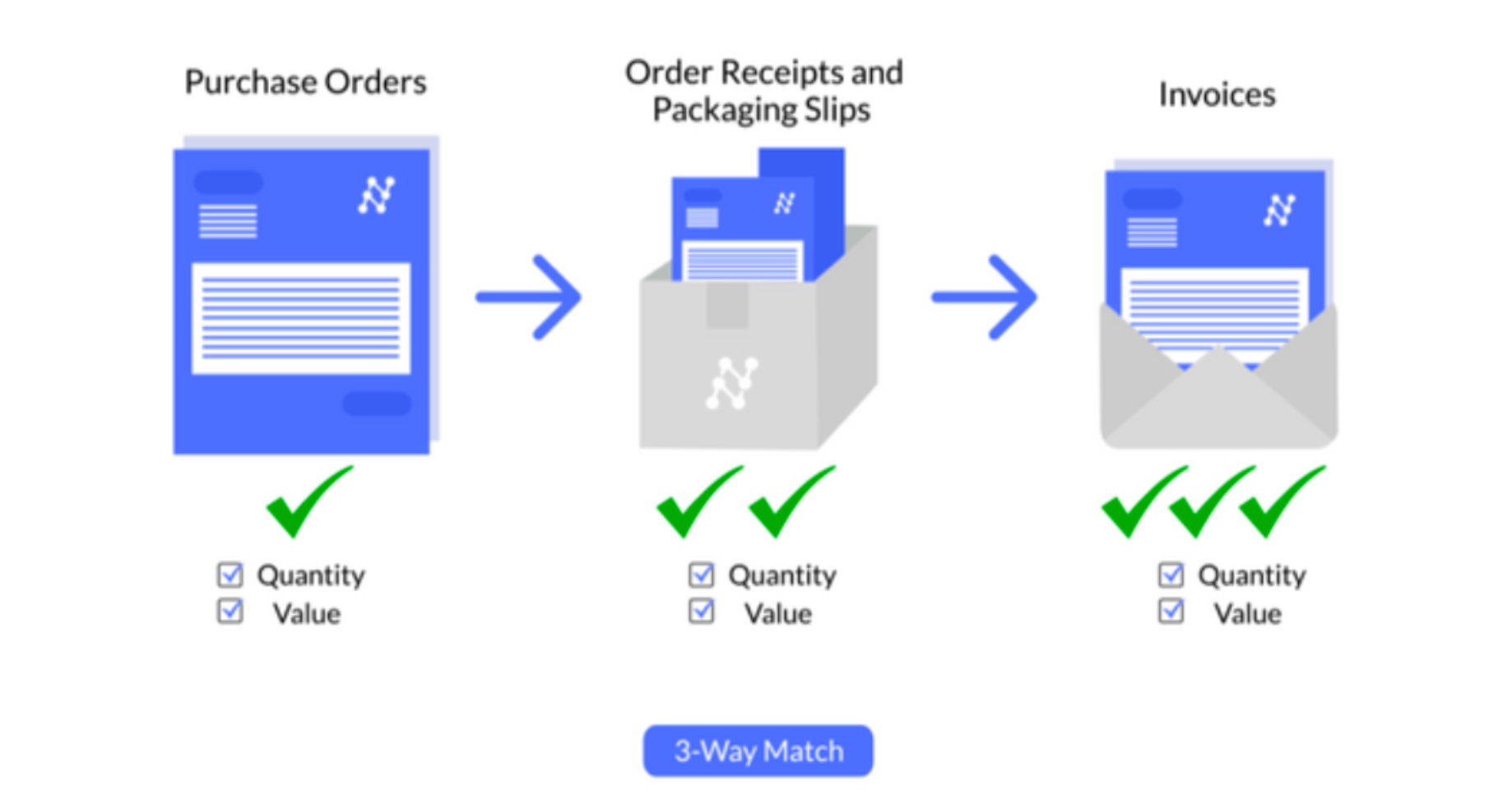

Bill Verification: Relying on the corporate’s insurance policies, invoices might endure two-way (bill and PO), three-way (bill, PO, and receiving report), or four-way (bill, PO, receiving report, and inspection report) matching to confirm transactions.

Approval: As soon as verified, invoices are routed for approval, usually involving a number of departments or ranges of authority.

Cost Processing: Authorized invoices are scheduled for fee primarily based on phrases and money move issues.

Reconciliation: Lastly, funds are reconciled in Xero, making certain that every one transactions are precisely mirrored in monetary data.

Automated AP Workflow with Nanonets

Now, let’s reimagine this workflow with Nanonets built-in into Xero:

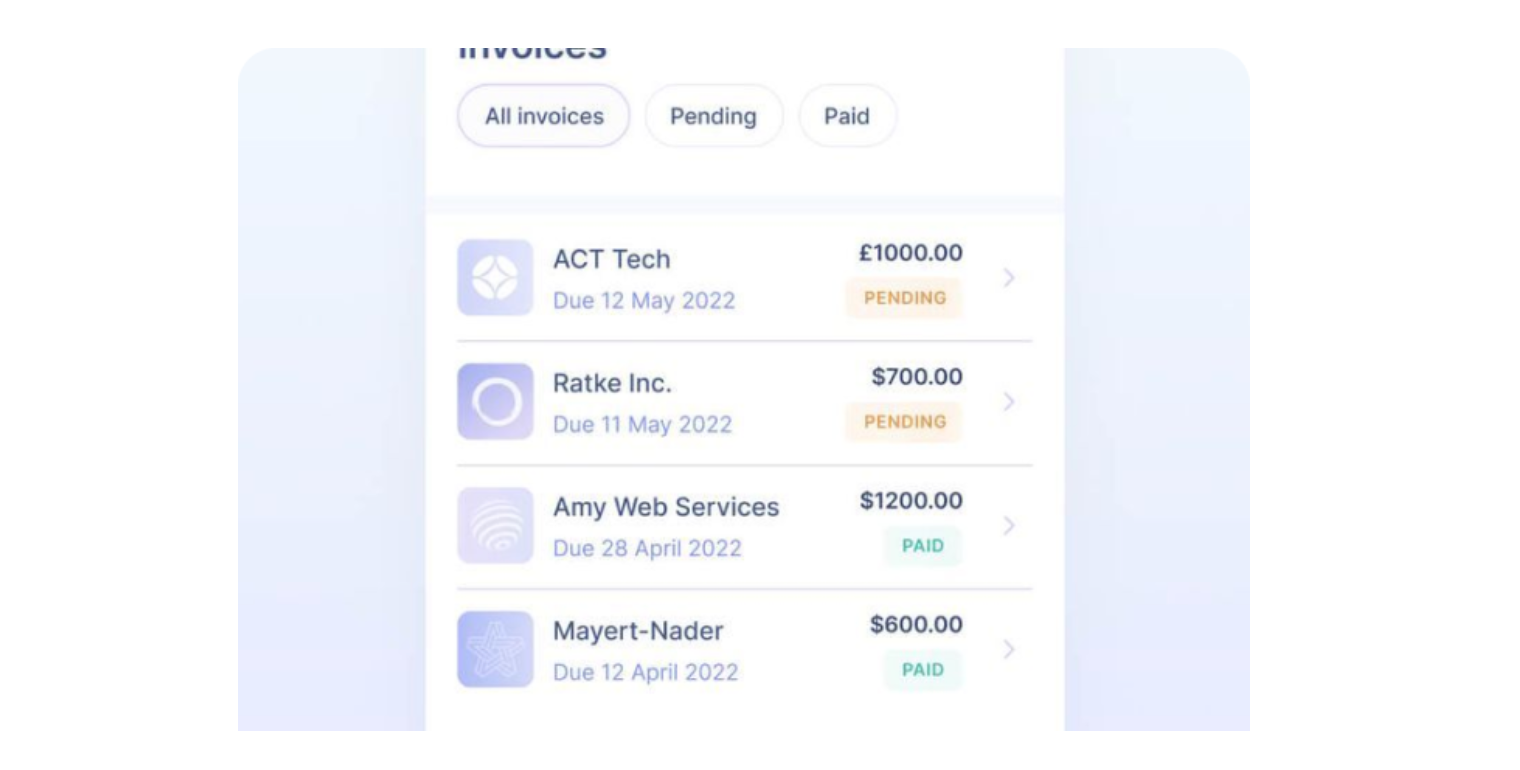

Bill Receipt: Image this- each bill your corporation receives, no matter its supply, lands neatly in a single digital spot. Invoices are robotically imported from the mess of emails, drives, and databases as quickly as they arrive, saving you time and decreasing errors.

Nanonets robotically reads emailed invoices from e mail physique and attachments.

All handwritten and printed invoices will be simply scanned utilizing a smartphone or straight uploaded into the platform.

Digital receipts can both be created and printed straight utilizing the Nanonets platform, or imported into Nanonets out of your mail, apps and databases.

This course of ensures that each piece of information, no matter its origin, finds its place in a centralized, digital repository, prepared for additional motion.

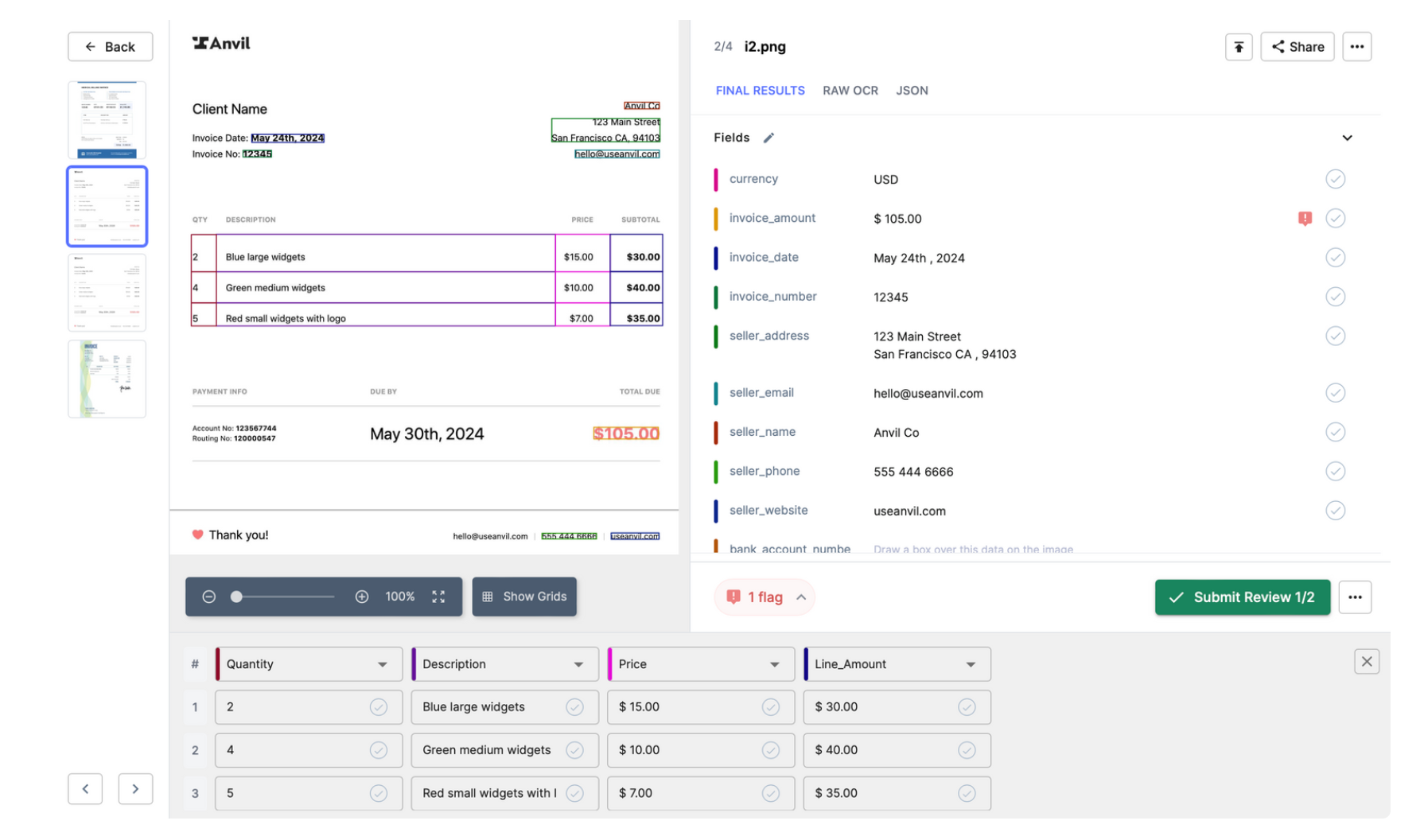

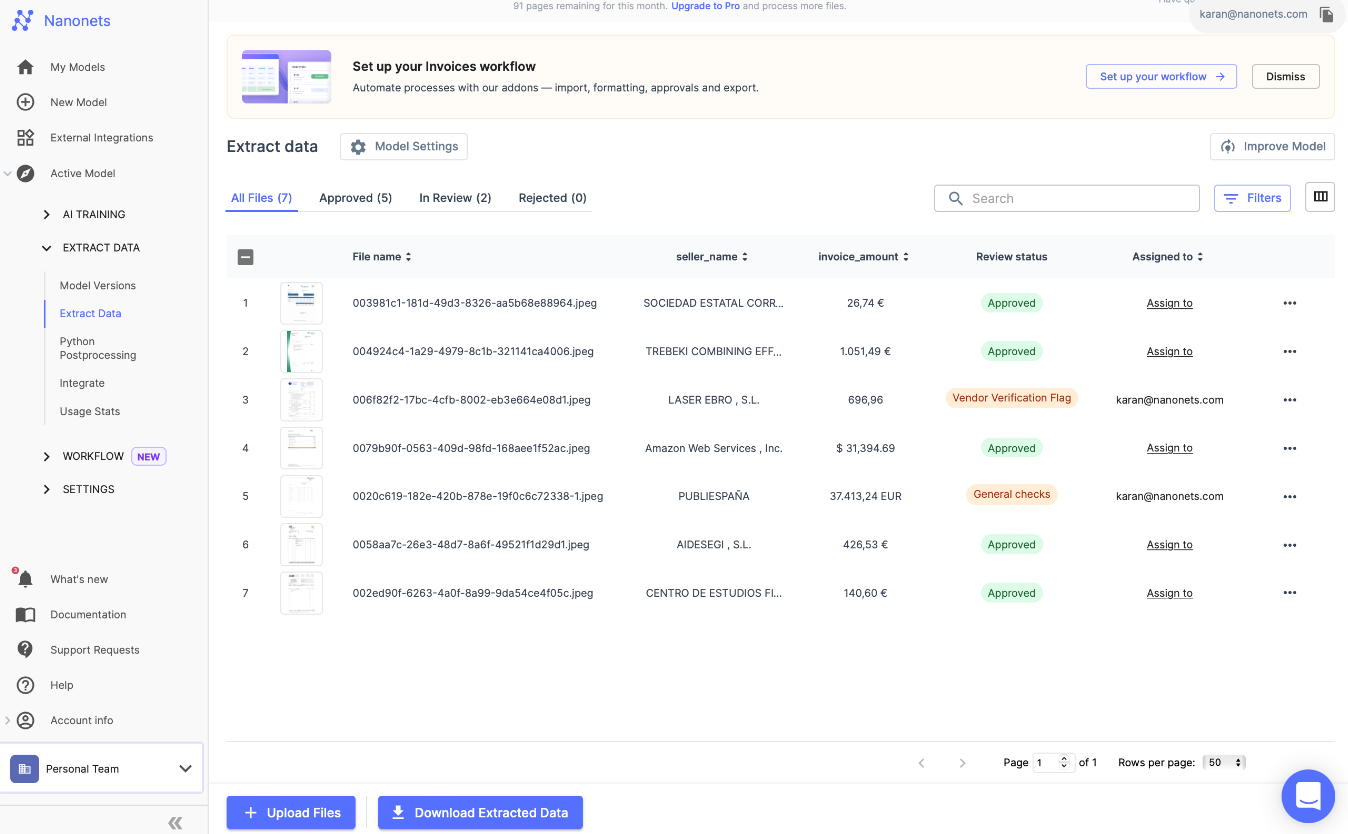

Automated Knowledge Entry: Nanonets AI reads invoices with over 99% accuracy, slicing down the hours to mere moments. This transformation means your staff can ditch the drudgery and dive into work that really issues. Knowledge is then extracted and straight inputted into Xero, with no guide information entry required.

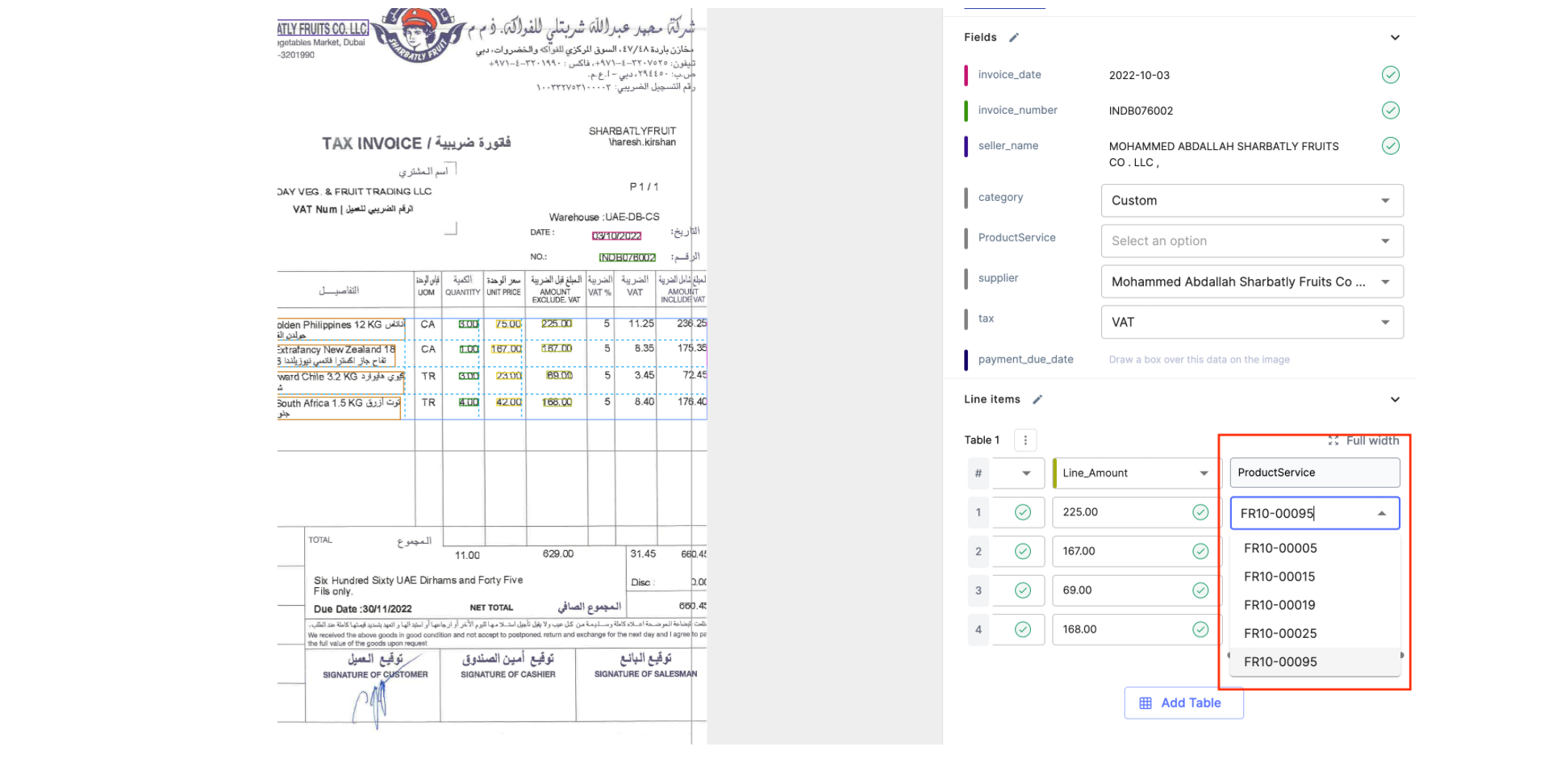

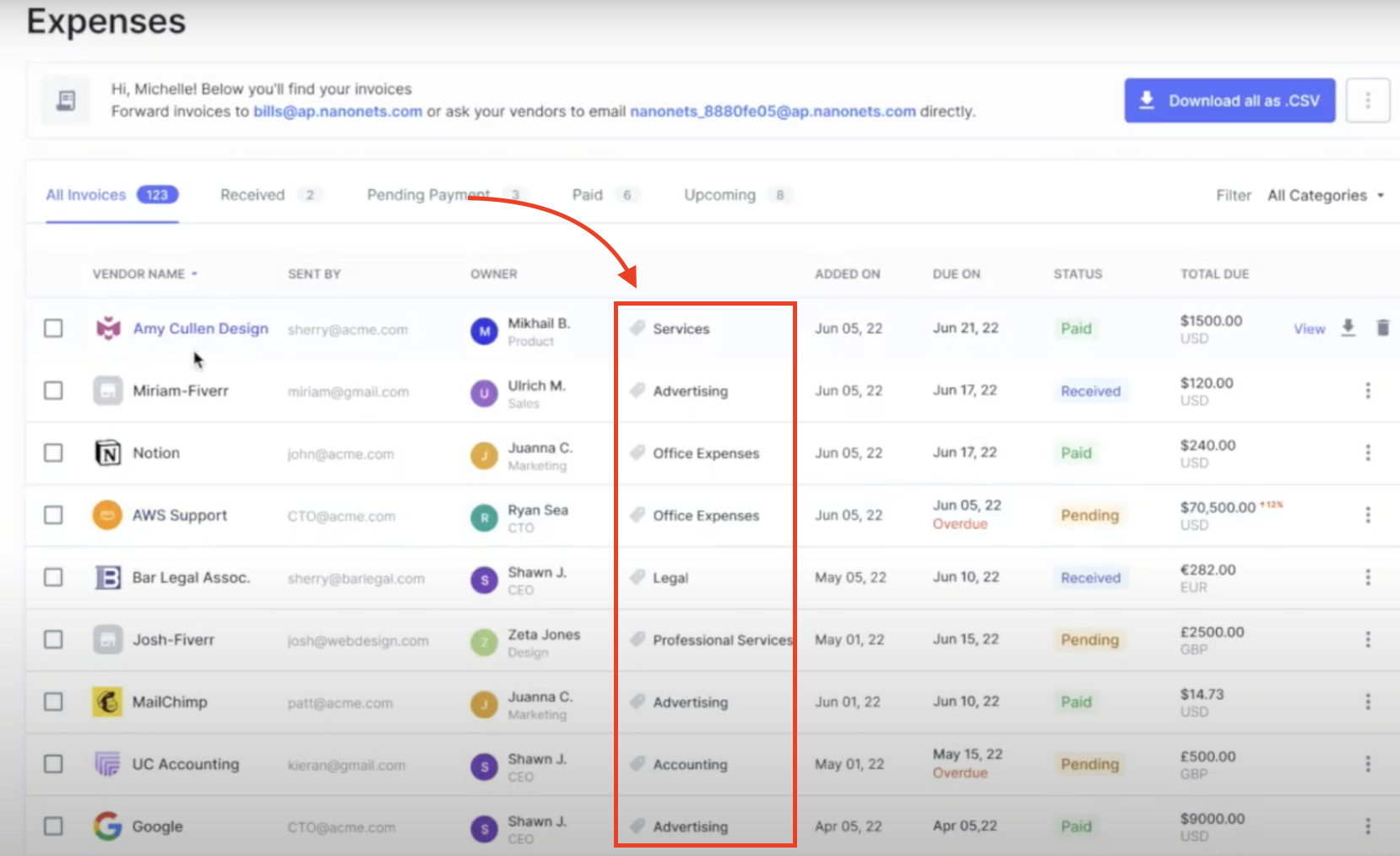

Automated Sorting and GL Coding: Nanonets makes use of OCR to robotically acknowledge and categorize invoices by vendor, date, quantity, and different related standards. GL code task will be automated by –

- Coaching on previous information: This includes importing historic monetary paperwork and transactions tagged with traditionally appropriate GL codes. The mannequin learns from these examples to precisely predict GL codes for brand spanking new transactions.

- Out of the Field Gen AI: Through the use of Nanonets GenAI, our software program can interpret the textual content on monetary paperwork in a means that mimics human understanding. This permits it to extract related data, context and semantics with the intention to apply complicated reasoning to assign GL codes precisely, even in instances the place transaction particulars are ambiguous or sparse.

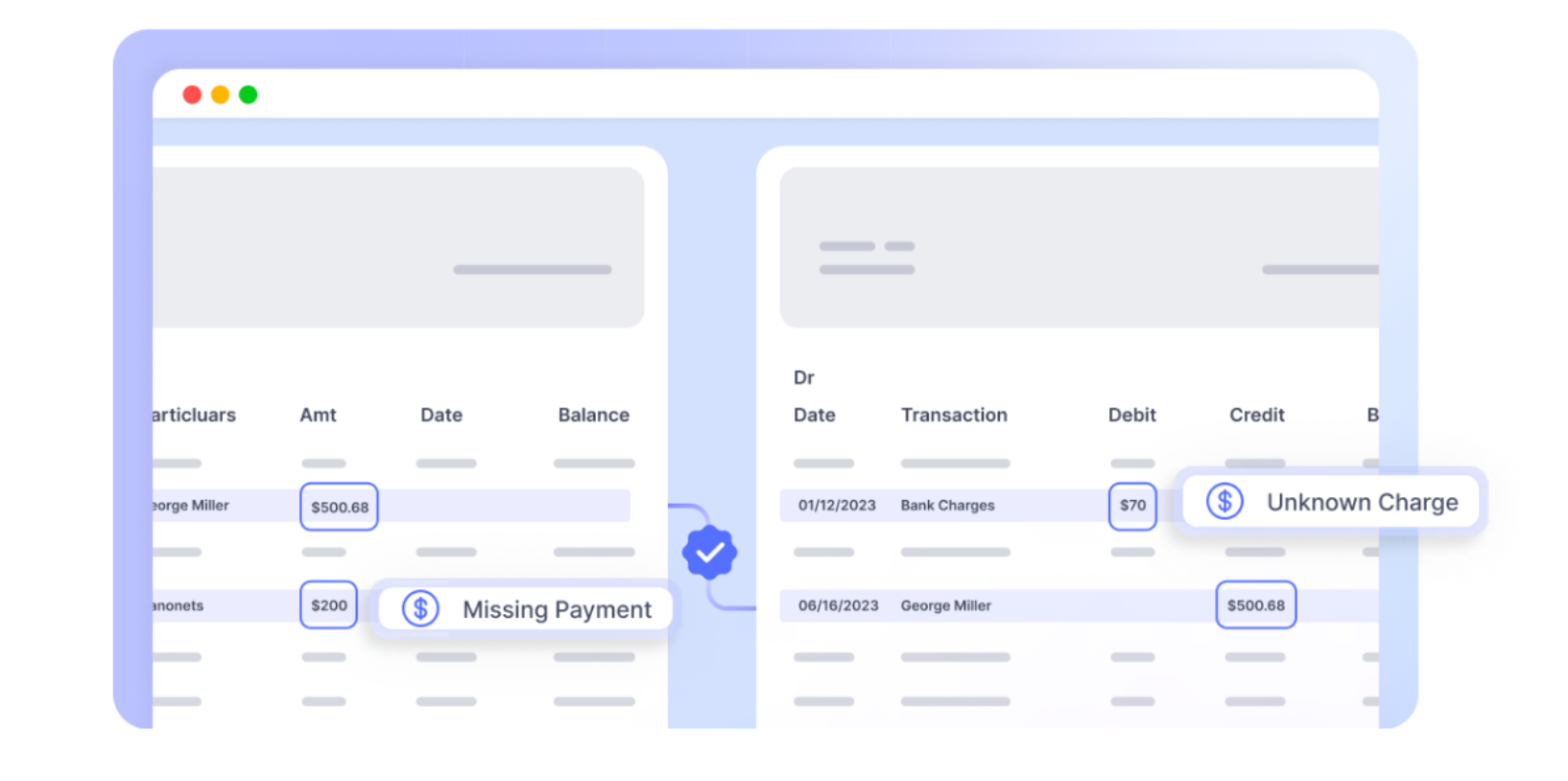

Clever Bill Verification: Leveraging AI, Nanonets robotically performs two-way, three-way, or four-way matching by studying and cross-referencing the extracted bill information with buy orders, receiving experiences, and inspection experiences current in Xero.

Validation: The system flags any discrepancies for human assessment, however in any other case, invoices that match firm standards are robotically routed for approval or straight authorized primarily based on pre-set guidelines.

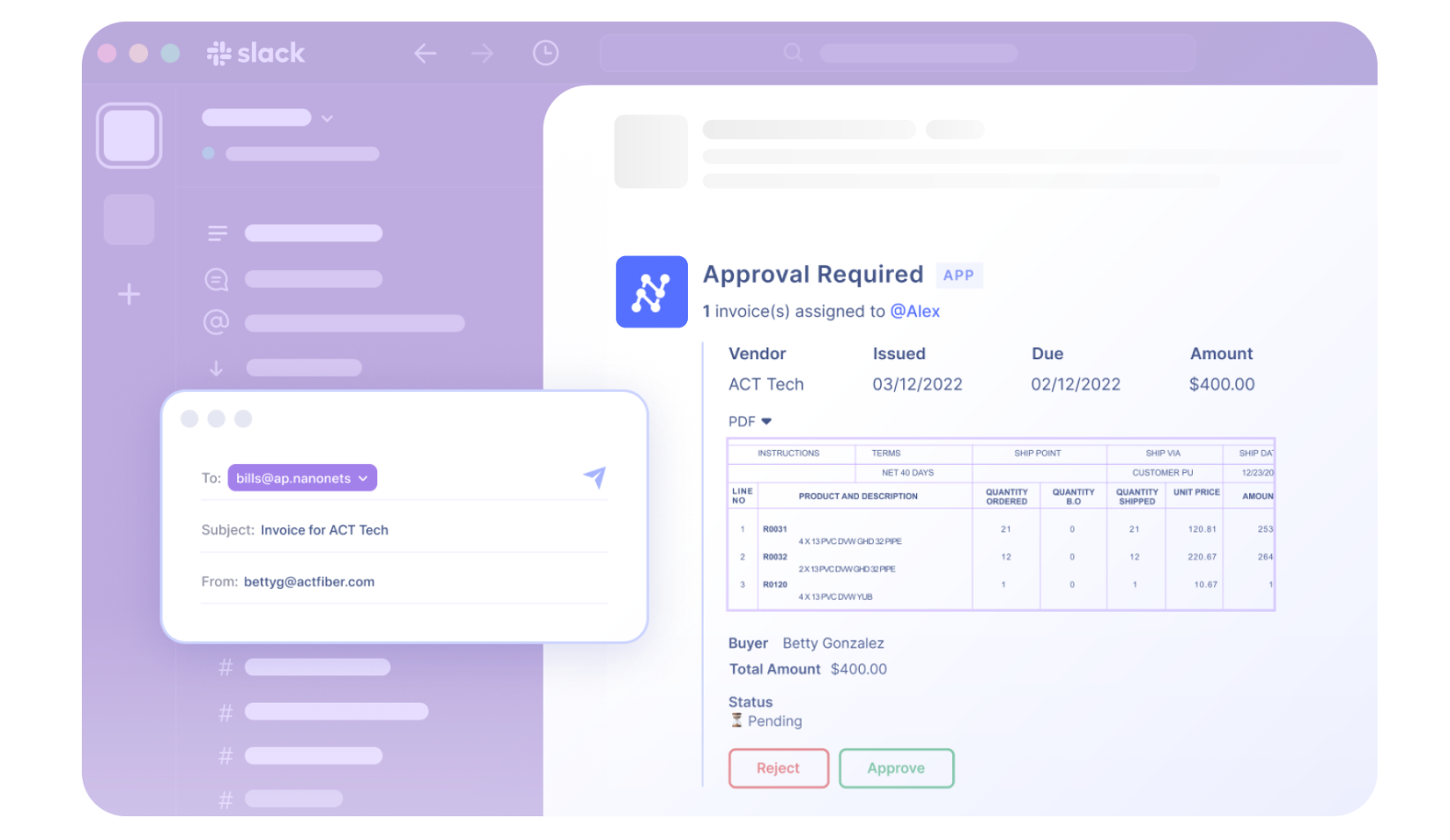

Approval: Approvals with Nanonets are now not a bottleneck. They turn out to be versatile and reside the place your group does—whether or not that is on e mail, Slack, or Groups. This eliminates the necessity for disruptive cellphone calls and the all-too-familiar barrage of reminders.

Cost Processing: Authorized invoices are robotically queued for fee in accordance with their phrases, optimizing money move administration.

Reconciliation: You’ll be able to import your financial institution statements, and Nanonets reconciles the funds robotically in Xero, making certain that monetary statements are up-to-date and correct, and your books shut 90% quicker.

We mentioned the tangible advantages of utilizing OCR and Bill Scanning Software program for Xero earlier. However on prime of that, the transition from a guide to an automatic AP course of represents not only a shift in how duties are carried out however a elementary transformation within the function of the finance division. With instruments like Nanonets, finance groups transfer from back-office features to strategic contributors, leveraging real-time information and analytics to drive enterprise choices. That is the way forward for finance, and it is accessible now for Xero customers by the facility of automation with Nanonets.

Steps to Combine Nanonets for Xero

You’ll be able to combine Nanonets with Xero, and begin utilizing the platform to automate your bill processing and AP workflows. Her’s learn how to get began –

- Select the Invoices pre-trained mannequin.

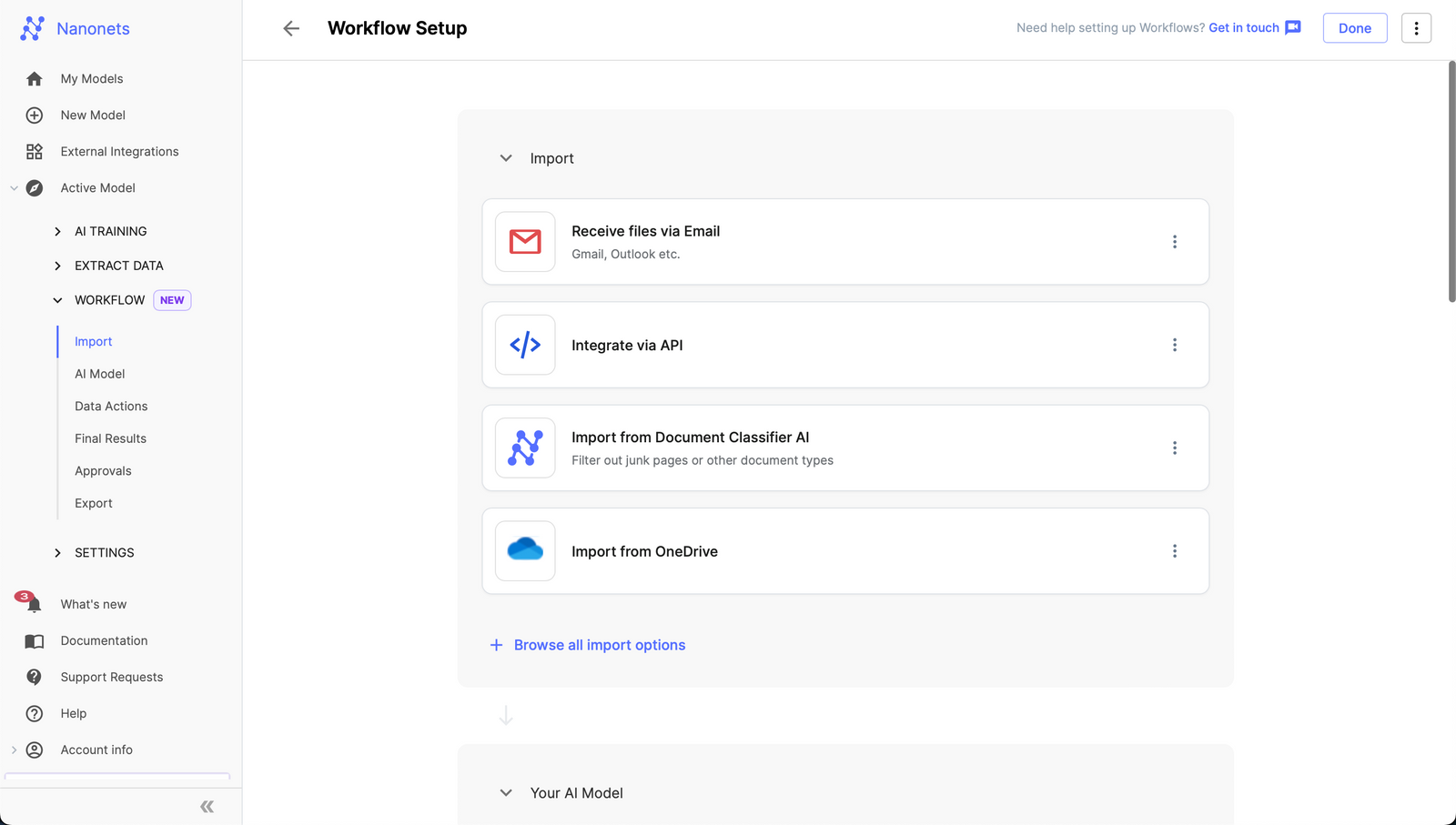

- After getting created the mannequin, navigate to the Workflow part within the left navigation pane.

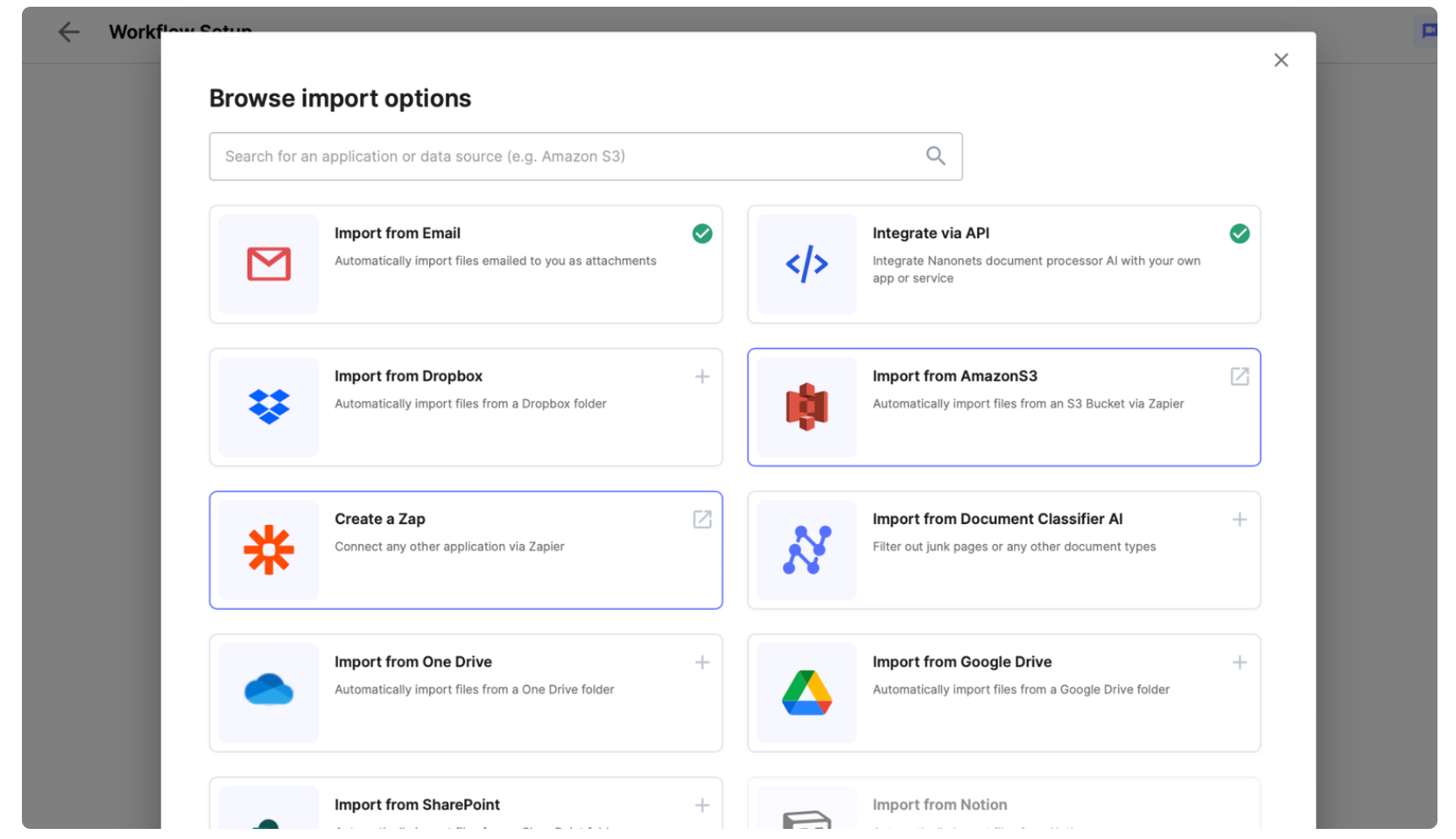

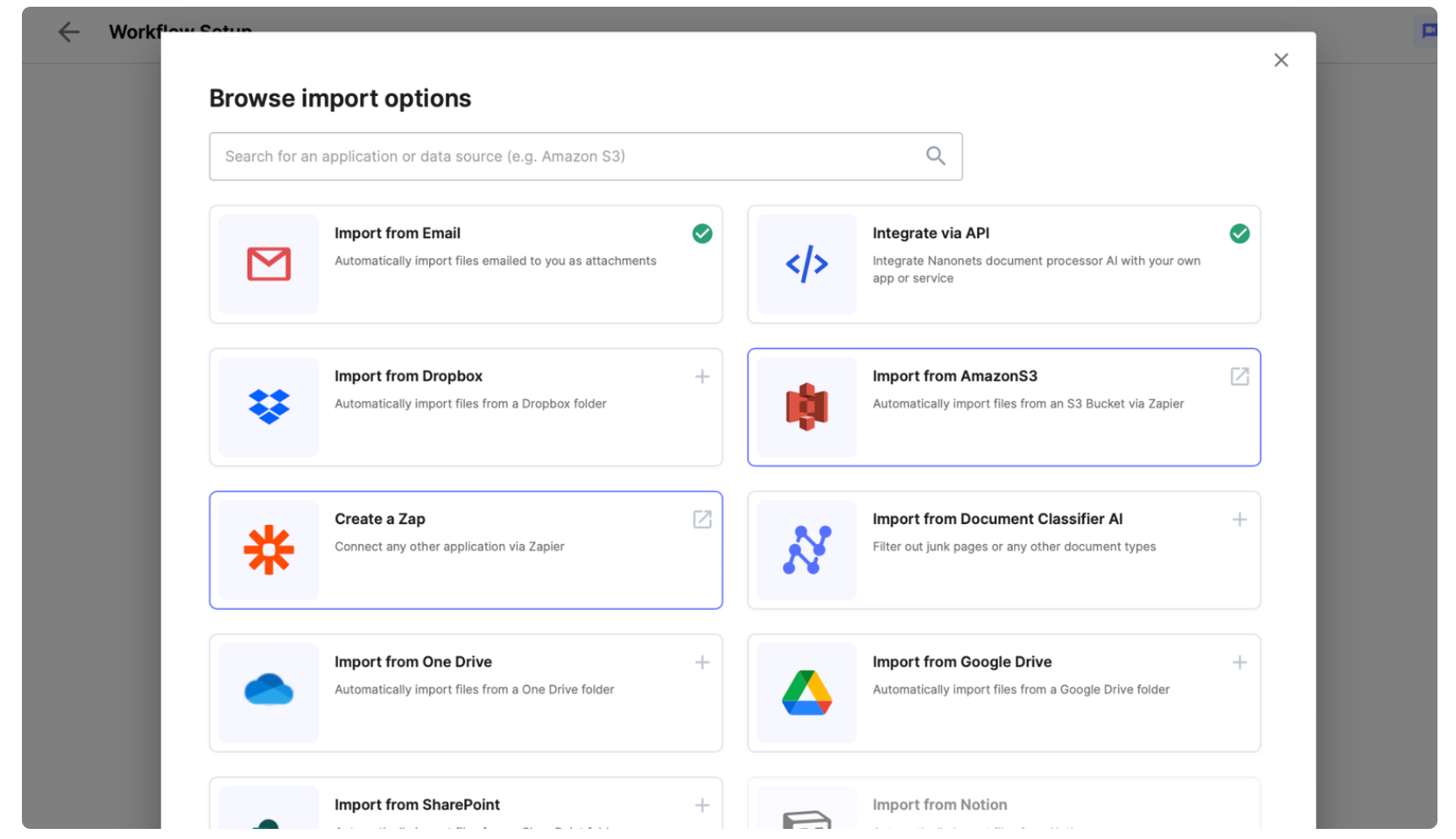

- Go to the import tab and configure your import choices –

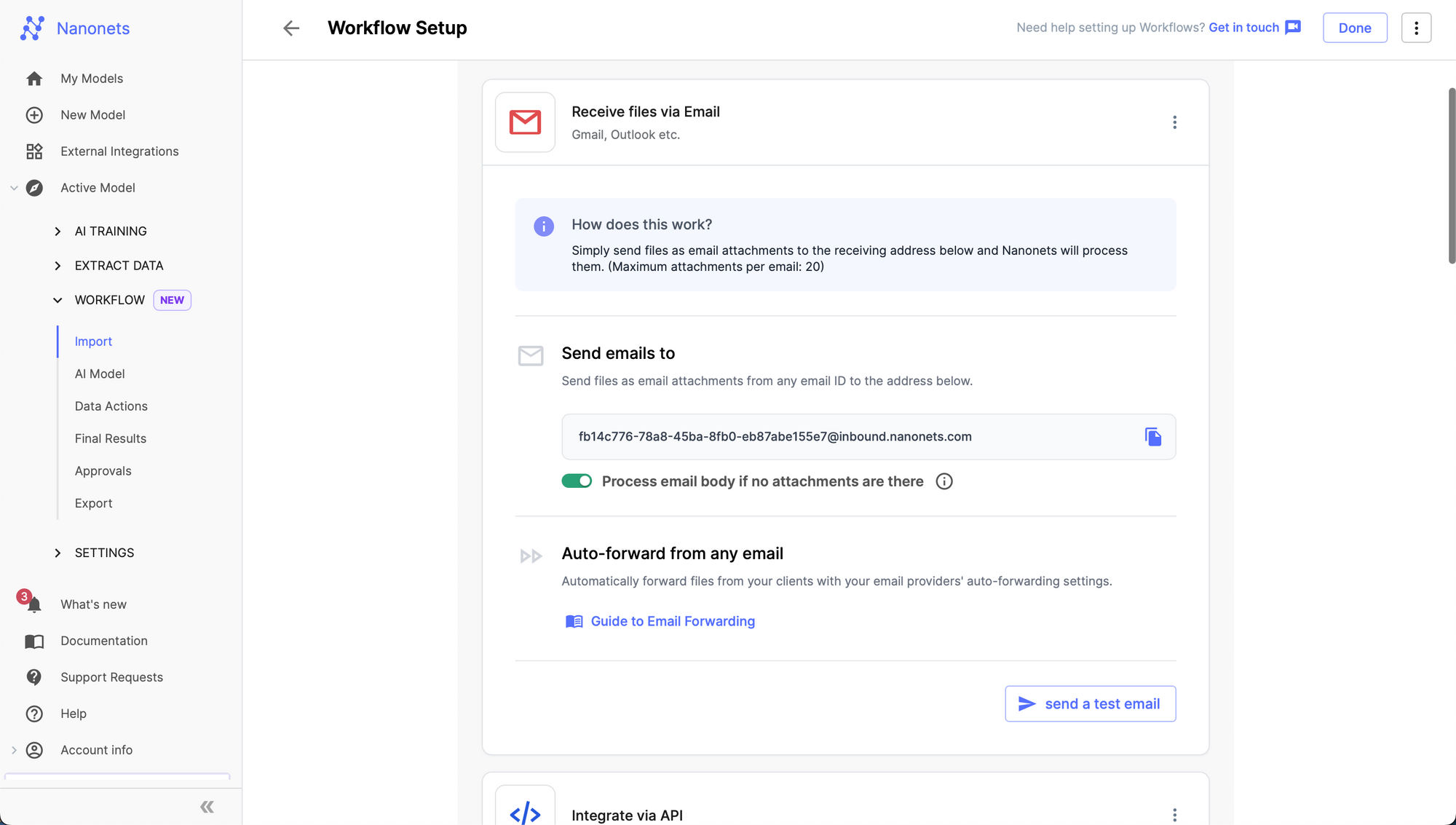

- 1. Electronic mail :

- Go to the import tab and click on on “Obtain information by way of Electronic mail”.

- Within the expanded view, it is possible for you to to search out an auto generated e mail tackle created by Nanonets.

- 1. Electronic mail :

- Any Electronic mail despatched to this tackle shall be ingested by the Nanonets mannequin you created and structured information shall be extracted from it. You’ll be able to arrange e mail forwarding to robotically ahead incoming emails from any e mail tackle to the Nanonets e mail tackle to automate e mail ingestion and information extraction.

- Learn to arrange Electronic mail Forwarding from any e mail

- 2. Automated Import from Apps and Databases

- Arrange your imports from the “Browse all import choices” modal.

- 3. Direct Add

- You may also select to straight take photographs and add invoices utilizing the Nanonets platform or cellular app.

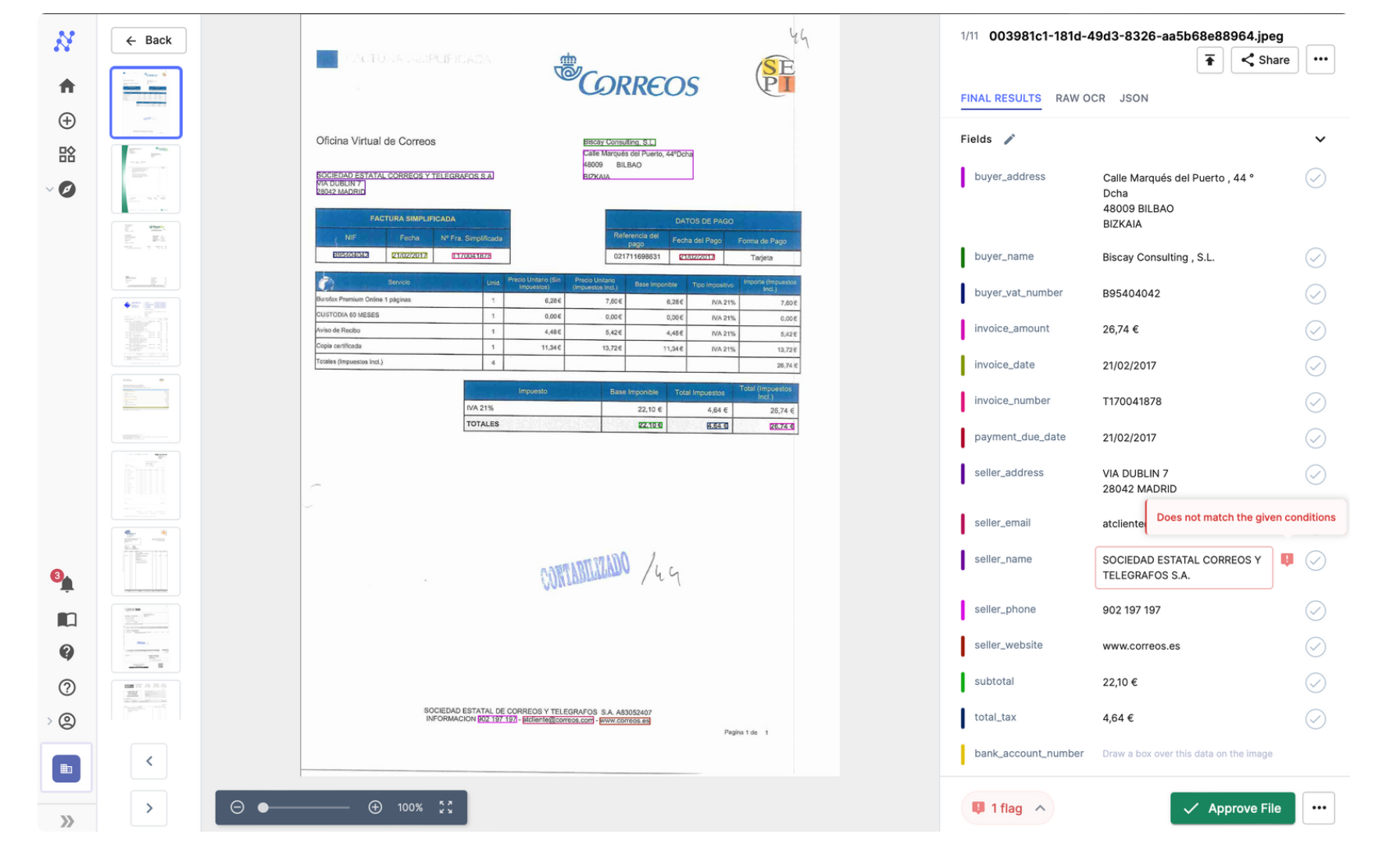

- Take a look at Knowledge Extraction: Add an bill and Nanonets works on the imported doc and extracts fields, line objects and tables.

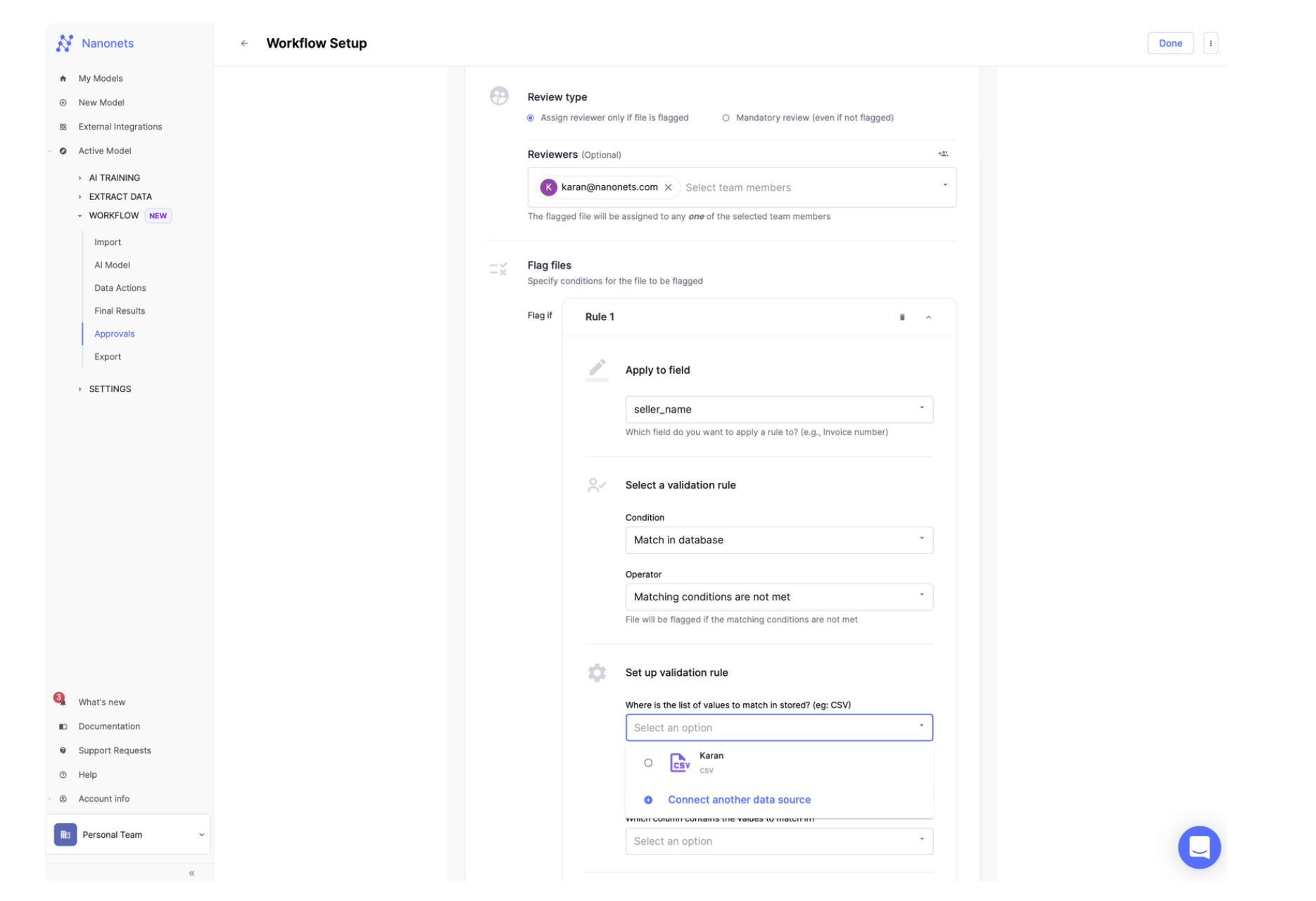

- Arrange any Validation Guidelines and Approval Steps: You’ll be able to carry out postprocessing of information, arrange conditional guidelines, assign guide approvers and arrange automated approval primarily based on validation guidelines. These guidelines can be primarily based on interacting with information situated on exterior software program / database by integrations.

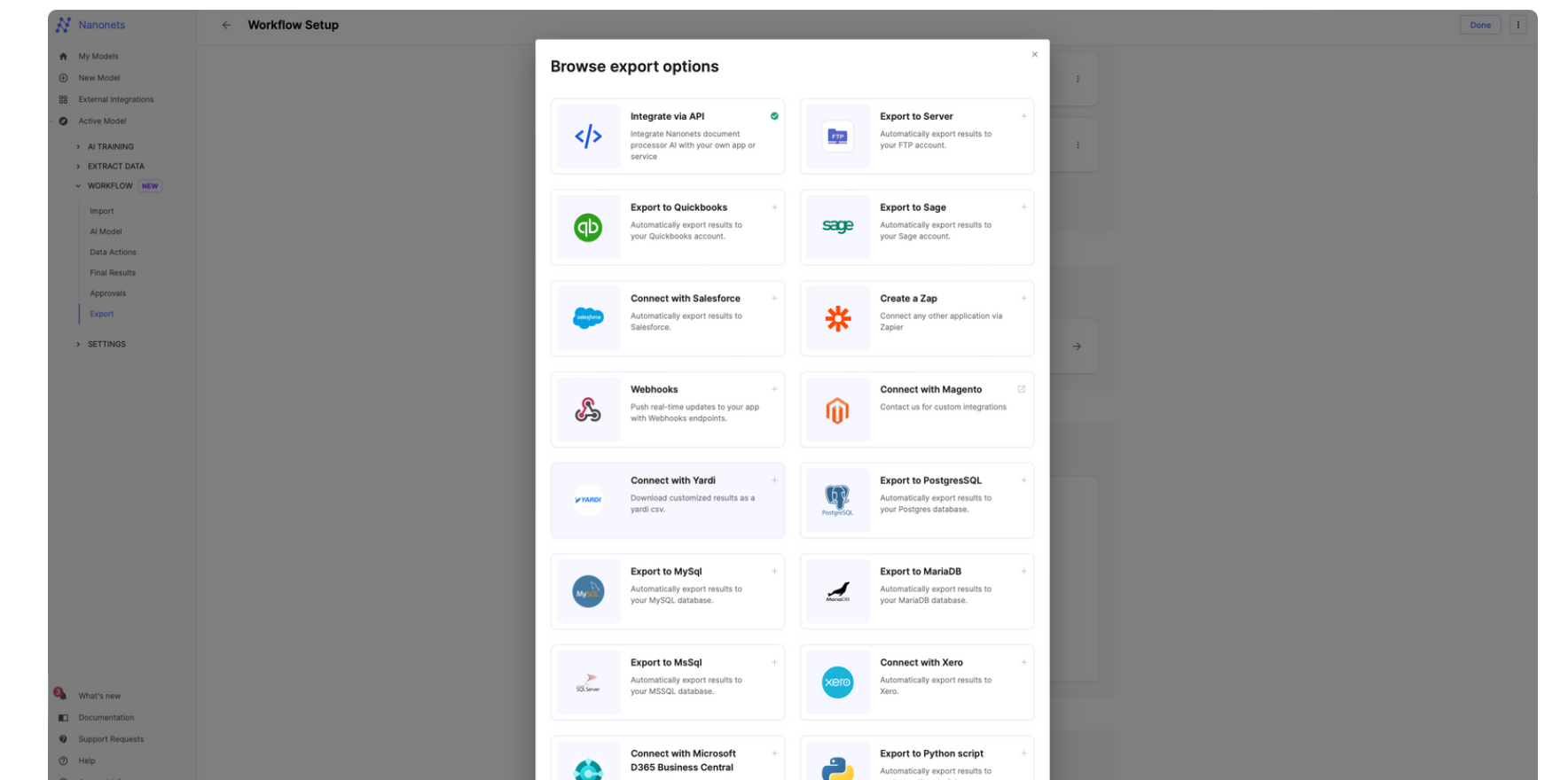

- Add the Xero Integration, Authenticate your Xero Account, and Arrange the export into Xero Accounting Software program.

This completes the fundamental arrange. You’ll be able to improve the Nanonets workflow additional and activate options reminiscent of GL coding and a couple of/3/4 means matching.

As we have explored, the mixing of Nanonets with Xero accounting software program is a game-changer for companies slowed down by the inefficiencies of guide bill processing. The evolution from guide to automated accounts payable processes is not only a step ahead; it is a leap right into a future the place monetary operations are streamlined, error charges plummet, and strategic decision-making is empowered by real-time information analytics. By shifting from guide drudgery to strategic perception, finance groups geared up with the correct automation instruments can drive their corporations in direction of larger profitability, agility, and aggressive benefit within the digital age.